Schedule M 1 Looking for a method to stay arranged? Free printable schedules are the perfect option! Whether you need a daily, weekly, or monthly planner, these templates assist you enhance jobs, manage your time, and boost performance. Created for flexibility, they're perfect for work, school, or home usage. Simply download, print, and start planning your days with ease.

With personalized choices, free printable schedules let you tailor your plans to fit your special needs. From colorful styles to minimalist designs, there's something for everyone. They're not only useful however likewise an economical way to monitor consultations, due dates, and objectives. Begin today and experience the difference an efficient schedule can make!

Schedule M 1

Schedule M 1

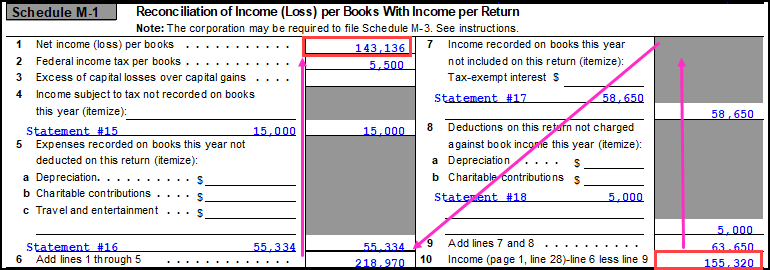

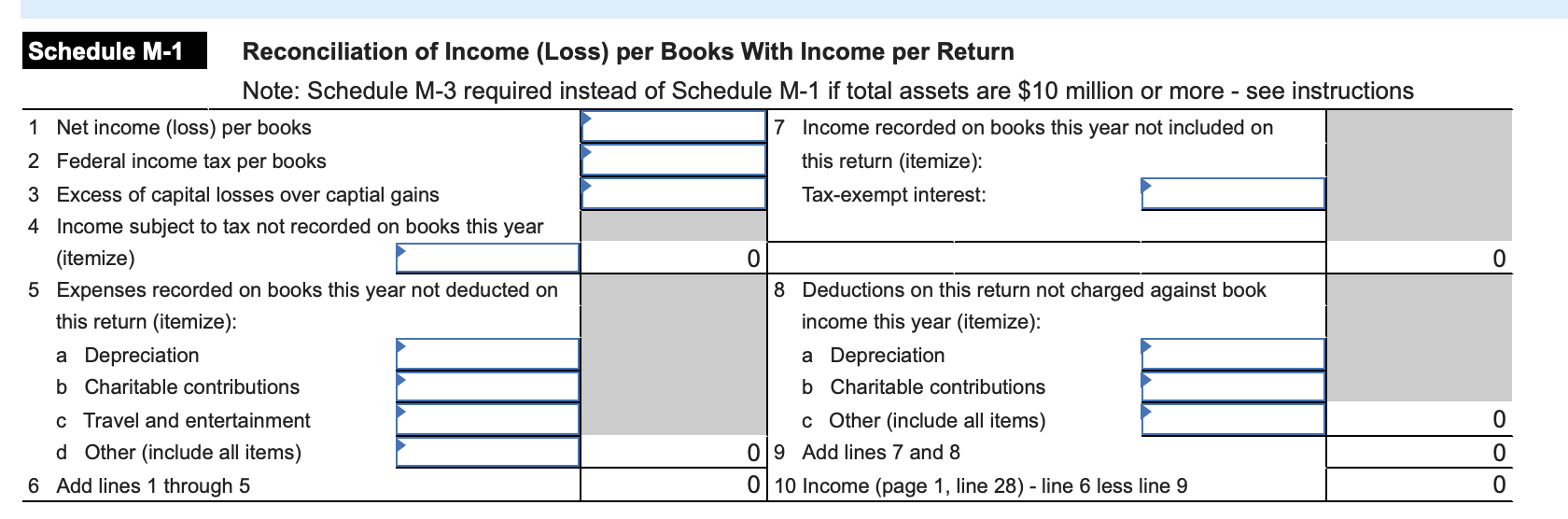

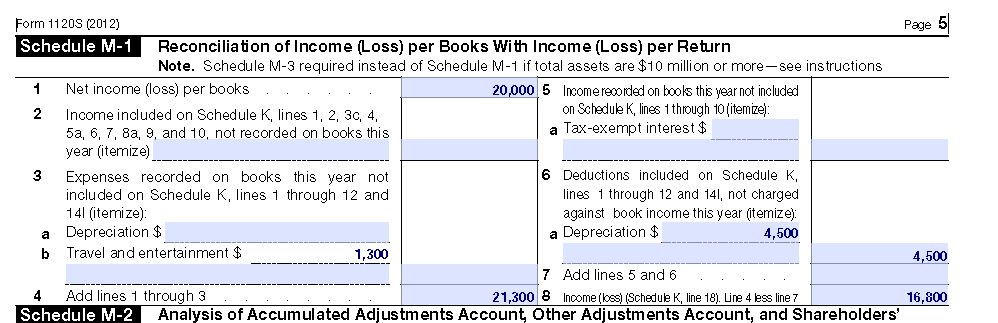

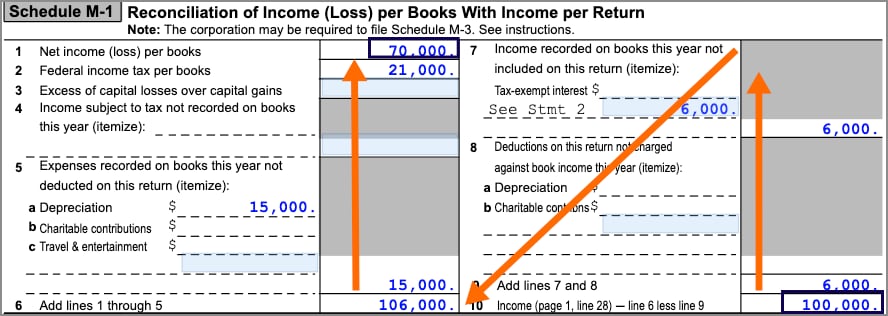

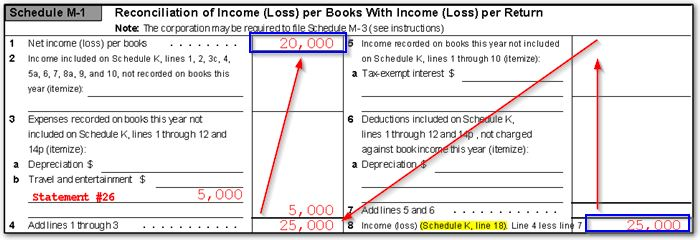

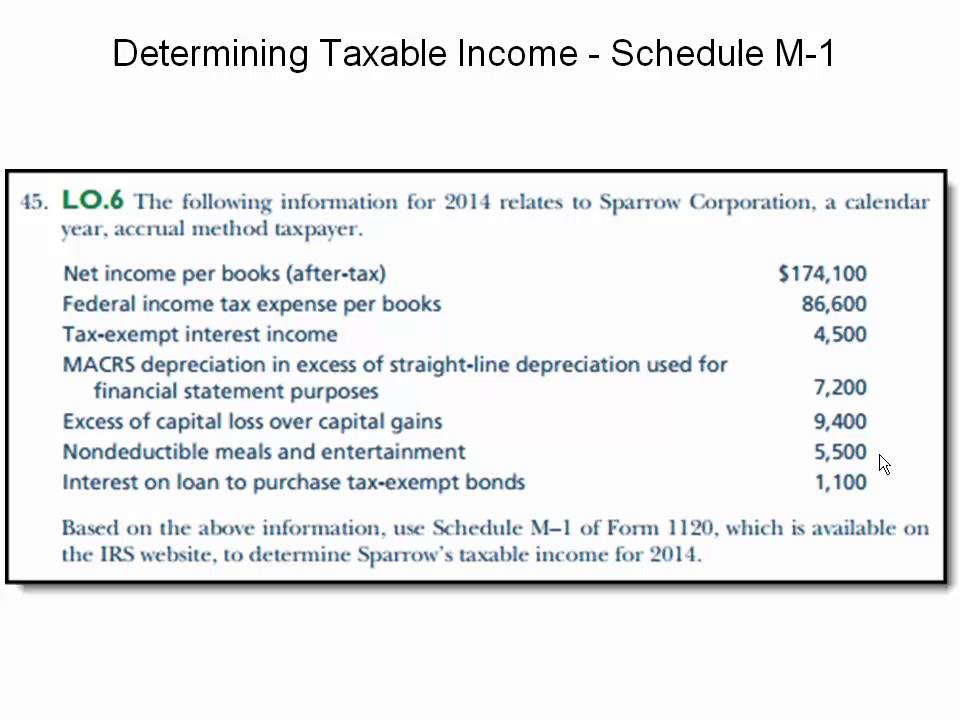

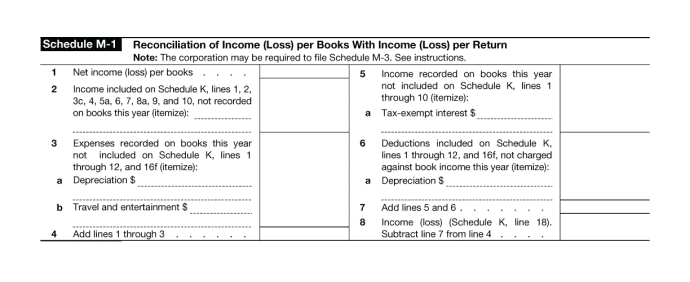

The net income loss per books amount that appears on Line 1 of Schedule M 1 Reconciliation of Income Loss per Books With Income Loss per Return is a The Schedule M-1 must be prepared by corporations with total receipts or total assets of $250,000 or more. The Schedule M-3 must be prepared by corporations ...

Form 1120 S Schedule M 1 Reconciliation of Income Loss per

Drake Tax - 1120: Calculating Book Income, Schedule M-1 and M-3

Schedule M 1Schedule M-1 includes two separate lines to enter the differences in depreciation. This menu line is for assets where the amount of depreciation ... Schedule M 1 is the bridge reconciliation between the books and records of a corporation and its income tax return Items included on this schedule will not

Schedule M-1 reports the taxpayer's current year net income and expenses as they are or would be shown on U.S. Form 1120, lines 1 through 28, in calculating ... Adam Markowitz, EA, CSLP on X: "This look right? #TaxTwitter -PPP expenses in Box 3 of M-1 -PPP income as tax-exempt in Box 5 of M-1 -Distributions wiped through OAA in M-2 Reporting Permanent vs. Temporary Differences for Schedule M-1 & M-3 - Lesson | Study.com

Three Year Comparison of Book Tax Differences M 1 M 3

Solved Prepare a Schedule M-1, page 5, Form | Chegg.com

Automatic Schedule M 1 adjustmentsExcess of capital losses over capital gain from Schedule DUtilization of capital loss carryover from prior years Form 1120-S Instructions: U.S. Return of Partnership Income

Schedule M 1 is required when the corporation s gross receipts or its total assets at the end of the year are greater than 250 000 The Form 1120: U.S. Corporation Income Tax Return 2023 Form 1120 Schedule M-3 | Fill and sign online with Lumin

Schedule M-1 | robergtaxsolutions.com

How are retained earnings calculated on Form 1120 in ProConnect Tax

What is Schedule M-1 and M-2? – Heard

Drake Tax - 1120: Calculating Book Income, Schedule M-1 and M-3

Drake Tax - 1120-S - Calculating Book Income, Schedule M-1 and M-3

Taxable Income - Schedule M-1 - Form 1120 - YouTube

What is the purpose of Schedule M-1 on Form 1120? - YouTube

Form 1120-S Instructions: U.S. Return of Partnership Income

Answered: M-1 Lines 7a and section 4 not populating in ProConnect - Intuit Accountants Community

Preparing Schedule M-1 or M-3 for a Business - Video | Study.com