Schedule G In 1120 Searching for a way to remain arranged? Free printable schedules are the ideal option! Whether you need a daily, weekly, or monthly planner, these templates help you enhance jobs, manage your time, and improve performance. Created for flexibility, they're ideal for work, school, or home usage. Merely download, print, and start planning your days with ease.

With customizable choices, free printable schedules let you tailor your strategies to fit your unique requirements. From colorful styles to minimalist layouts, there's something for everyone. They're not just useful but also a budget-friendly method to keep an eye on visits, due dates, and objectives. Get going today and experience the difference an efficient schedule can make!

Schedule G In 1120

Schedule G In 1120

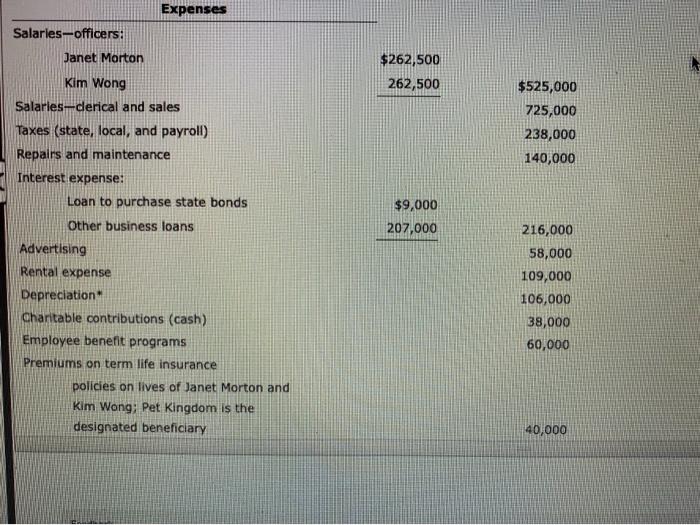

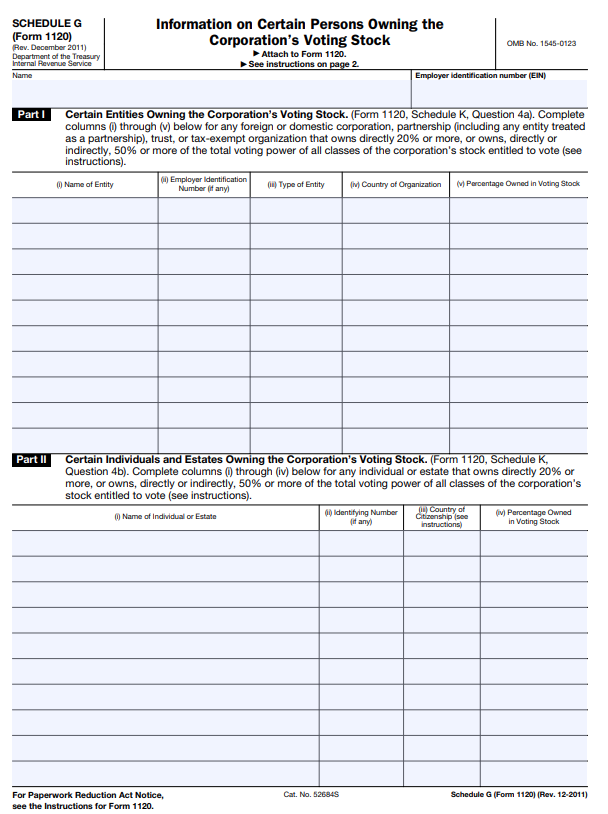

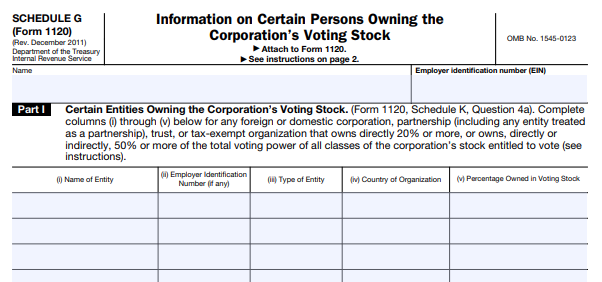

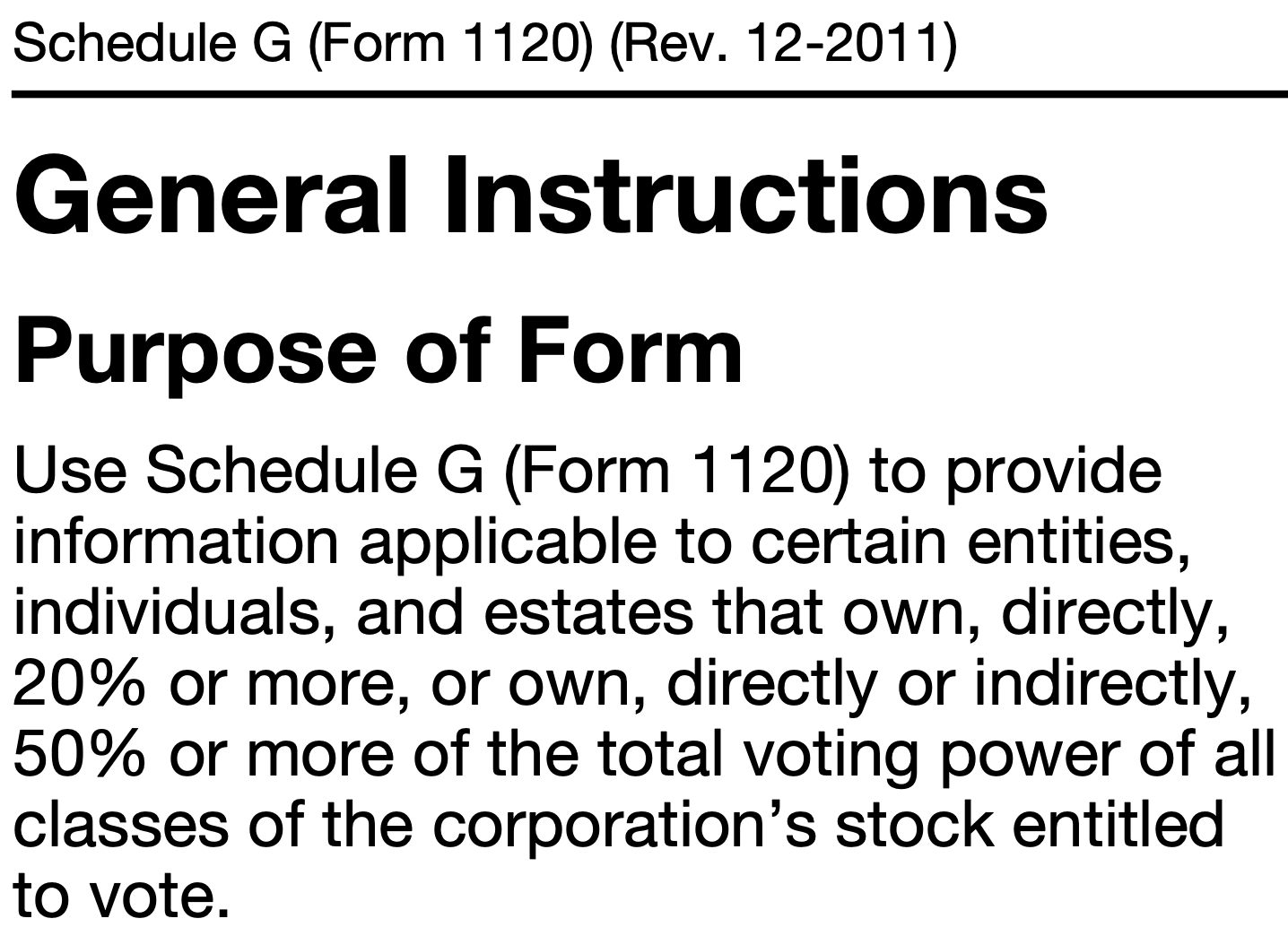

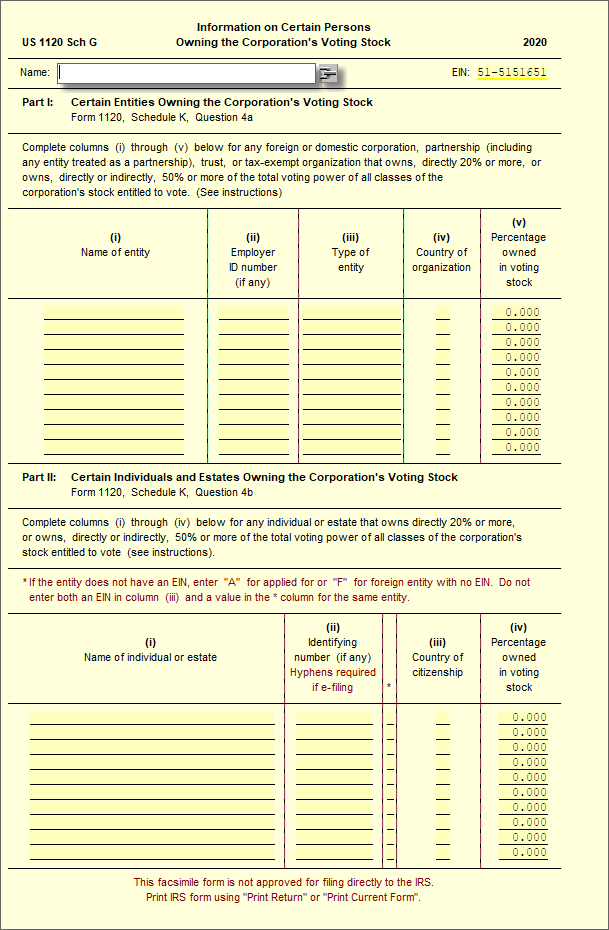

It helps capture information related to parent subsidiary structures brother sister relationships and other affiliations Schedule G (Form 1120) is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, ...

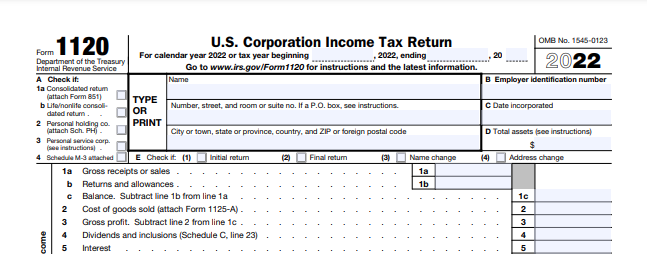

Form 1120 C Schedule G calculation Thomson Reuters

What is IRS Form 1120 Schedule G?

Schedule G In 1120Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, ... Use Schedule G Form 1120 to provide information applicable to certain entities individuals and estates that own directly 20 or more or own directly or

Schedule G (Form 1120) is an IRS form that requires corporations to report certain information on shareholders owning the corporation's voting stock. Form 1120 Filing Guide: Corporate Tax Return & Schedules Explained Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 Click here to watch full video: https://www.youtube.com/watch?v=_OV1KAfs21U #ScheduleG1120 #TaxPlanningTips #MeruAccounting #TaxCompliance

Schedule G Form 1120 Accessible Fill and sign online with Lumin

What is IRS Form 1120 Schedule G?

Schedule G is prepared when the cooperative s total receipts or assets at the end of the year are 250 000 or more You may force or prevent the preparation Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 Click here to watch full video: https://www.youtube.com/watch?v=_OV1KAfs21U #ScheduleG1120 #TaxPlanningTips #MeruAccounting #TaxCompliance

IRS Form 1120 Schedule G is used to provide information applicable to certain entities individuals and estates that own directly 20 or more or own Schedule G: Owners of Corporation's Voting Stock — Vintti What is IRS Form 1120 Schedule G?

How to Fill Out Form 1120 Schedule G: A Guide for Startup Founders

Sch G (1120) - Information on Persons Owning Voting Stock – UltimateTax Solution Center

Schedule G Form ≡ Fill Out Printable PDF Forms Online

Form 1120 Schedule G - Persons Owning Corporation Stock - YouTube

Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 - YouTube

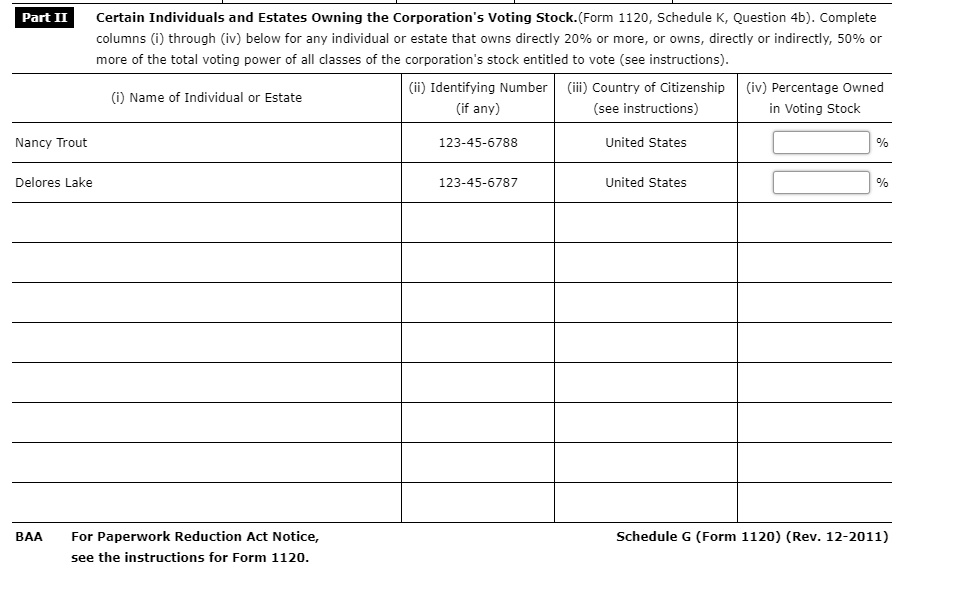

Note: This problem is for the 2018 tax year. On | Chegg.com

Schedule G (Form 1120) Accessible | Fill and sign online with Lumin

Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 Click here to watch full video: https://www.youtube.com/watch?v=_OV1KAfs21U #ScheduleG1120 #TaxPlanningTips #MeruAccounting #TaxCompliance

Schedule J 'Tax computation and Payment' on Form 1120 for tax years before the Tax Cuts and Jobs Act - YouTube

Solved Instructions Form 1120, pages 1, 2 and 3 Form 1120, | Chegg.com