Schedule C Vs Schedule E Trying to find a way to remain arranged? Free printable schedules are the perfect solution! Whether you require a daily, weekly, or monthly planner, these templates help you simplify jobs, handle your time, and improve performance. Designed for adaptability, they're ideal for work, school, or home use. Merely download, print, and start preparing your days with ease.

With adjustable options, free printable schedules let you customize your plans to fit your special needs. From colorful styles to minimalist layouts, there's something for everybody. They're not just useful but also an economical way to keep an eye on appointments, deadlines, and goals. Start today and experience the difference a well-organized schedule can make!

Schedule C Vs Schedule E

Schedule C Vs Schedule E

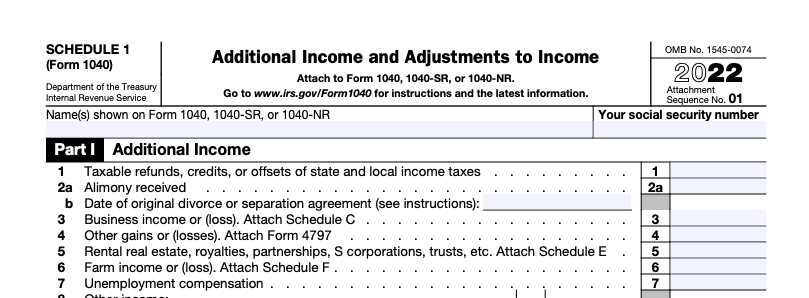

However if you provide substantial services in conjunction with the property or the rental you can use Schedule C to report the income Schedule C income is subject to the self-employment tax. Schedule E income is normally excluded from the self-employment tax, but the exclusion ...

Vacation Home Rental What s Best for You Schedule C or E

Airbnb Taxes: Schedule C Vs. Schedule E - Passive Airbnb

Schedule C Vs Schedule ESchedule C and E are the two schedules that are generally used to report the rental income. These schedules are part of Form 1040 which every ... Schedule E is used to report passive income which includes self charged interest rental property income royalties and business activities generating income

If you personally used the rental property and only rented it occasionally, you may not need to file Schedule C or Schedule E, meaning you won't owe tax on the ... Schedule C vs. Schedule E: Which One is Right for Your Short-Term Rental? - David Weinstein MBA CPA CFE IRS Schedule E Instructions - Supplemental Income and Loss

Which schedule E or C TurboTax Support Intuit

Schedule C vs Schedule E for Airbnb Income

Schedule C is used for reporting business income If your rental properties are owned under an LLC for which you are the sole owner you must use this form Schedule C vs Schedule E For Rental Property – Landlord Studio

You can generally use Schedule E Form 1040 Supplemental Income and Loss to report income and expenses related to real estate rentals Schedule E vs Schedule C for Short-Term Rentals IRS Schedule C: Self-Employed and Independent Contractor Taxes

Schedule C - What Is It, How To Fill, Example, Vs Schedule E

What is a Schedule C? Instructions and examples for 2024

IRS Schedule E: The Ultimate Guide for Real Estate Investors

A Breakdown of your Schedule E Expense Categories – Landlord Studio

Schedule C vs. Schedule E: Which One is Right for Your Short-Term Rental? - David Weinstein MBA CPA CFE

Schedule C - What Is It, How To Fill, Example, Vs Schedule E

Airbnb & VRBO Income Taxes: Schedule E or Schedule C for Reporting? (Tax Tuesday Question) - YouTube

Schedule C vs Schedule E For Rental Property – Landlord Studio

Schedule C vs. E: Business & Rental Insights

An Overview of the Schedule C - Paper and Spark