Schedule A Form 8936 Searching for a method to stay arranged? Free printable schedules are the best service! Whether you require a daily, weekly, or monthly planner, these templates assist you improve jobs, manage your time, and enhance productivity. Designed for versatility, they're perfect for work, school, or home use. Simply download, print, and begin planning your days with ease.

With customizable alternatives, free printable schedules let you tailor your plans to fit your special requirements. From colorful designs to minimalist designs, there's something for everybody. They're not just useful however also an affordable way to monitor appointments, due dates, and objectives. Get going today and experience the distinction a well-organized schedule can make!

Schedule A Form 8936

Schedule A Form 8936

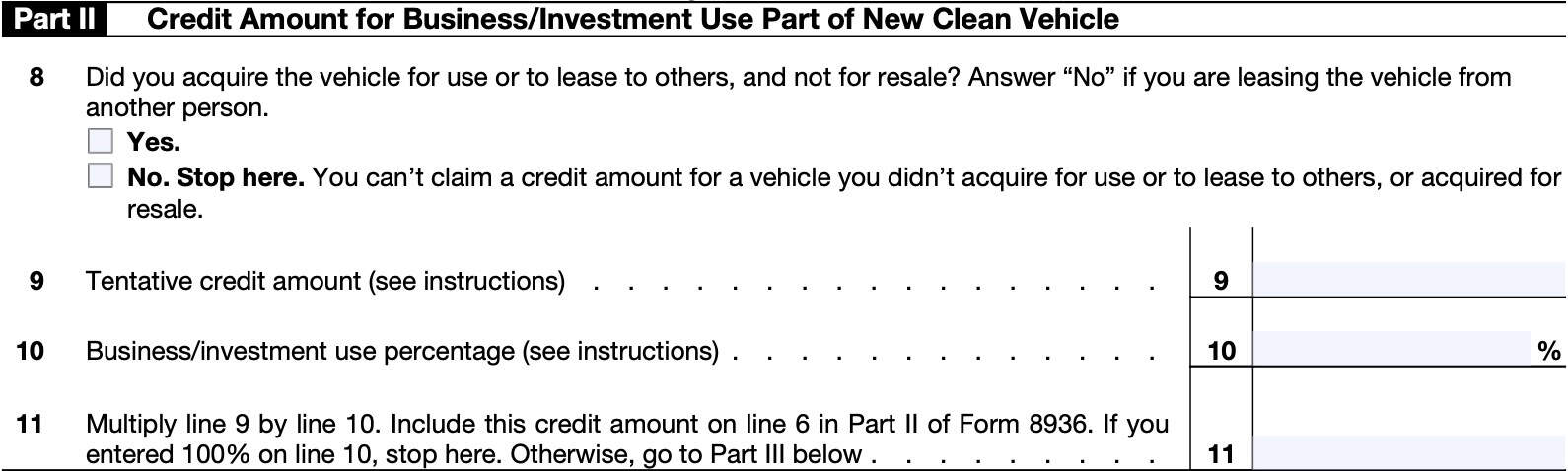

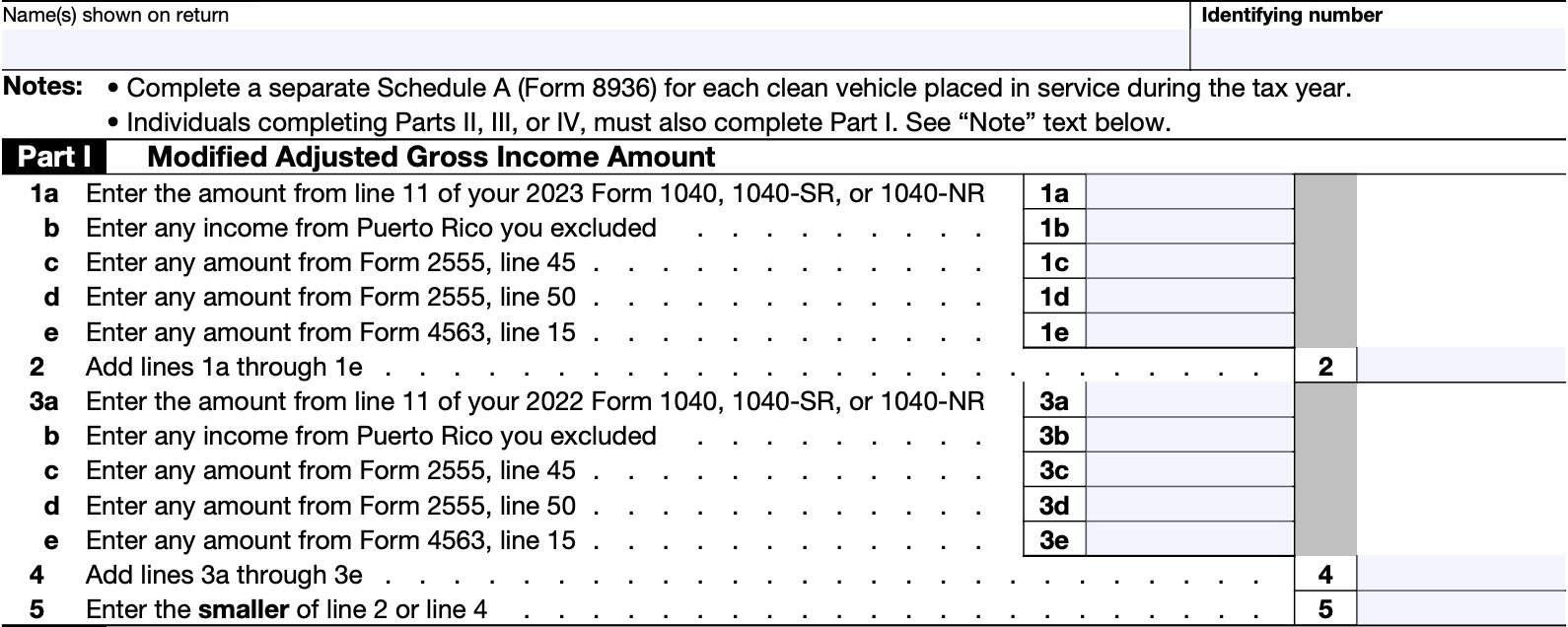

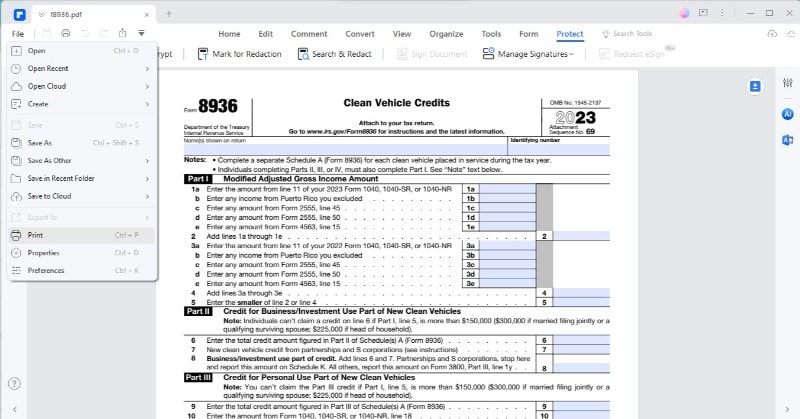

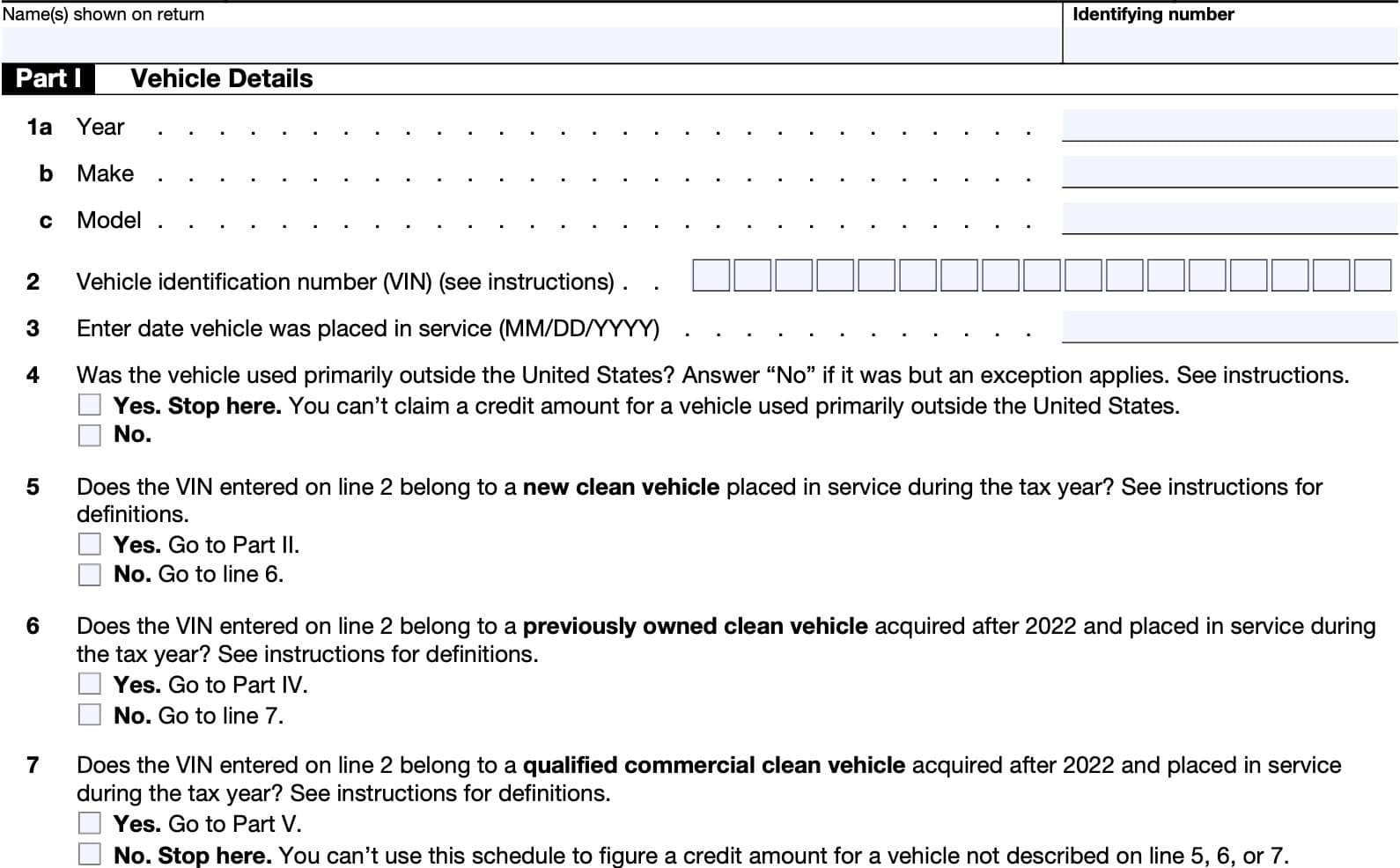

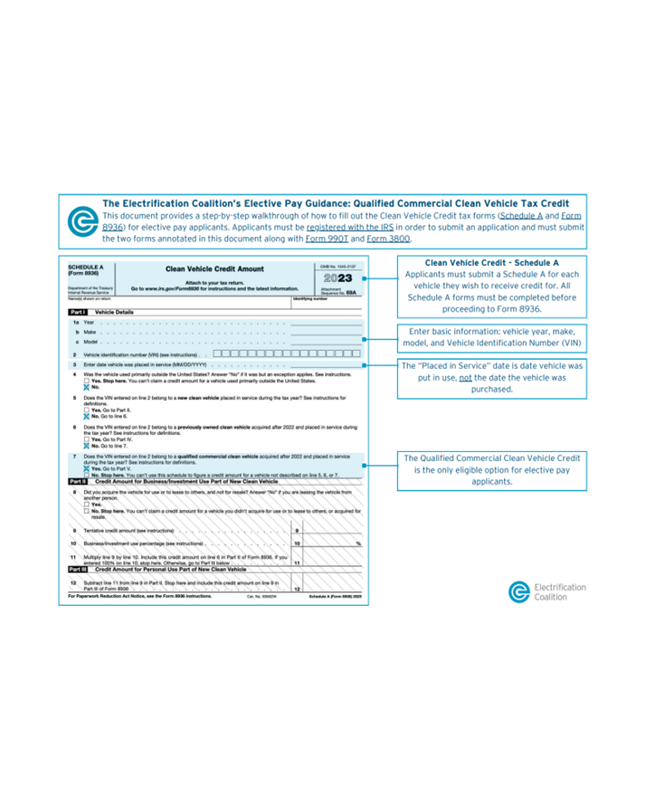

Applicants must submit a Schedule A for each vehicle they wish to receive credit for All Schedule A forms must be completed before proceeding to Form 8936 Start by gathering the necessary vehicle information, including the VIN and purchase date. Follow the instructions carefully to ensure a successful claim.

2023 Tax Form 8936 Schedule A FreeTaxUSA

Tax Form Annotations

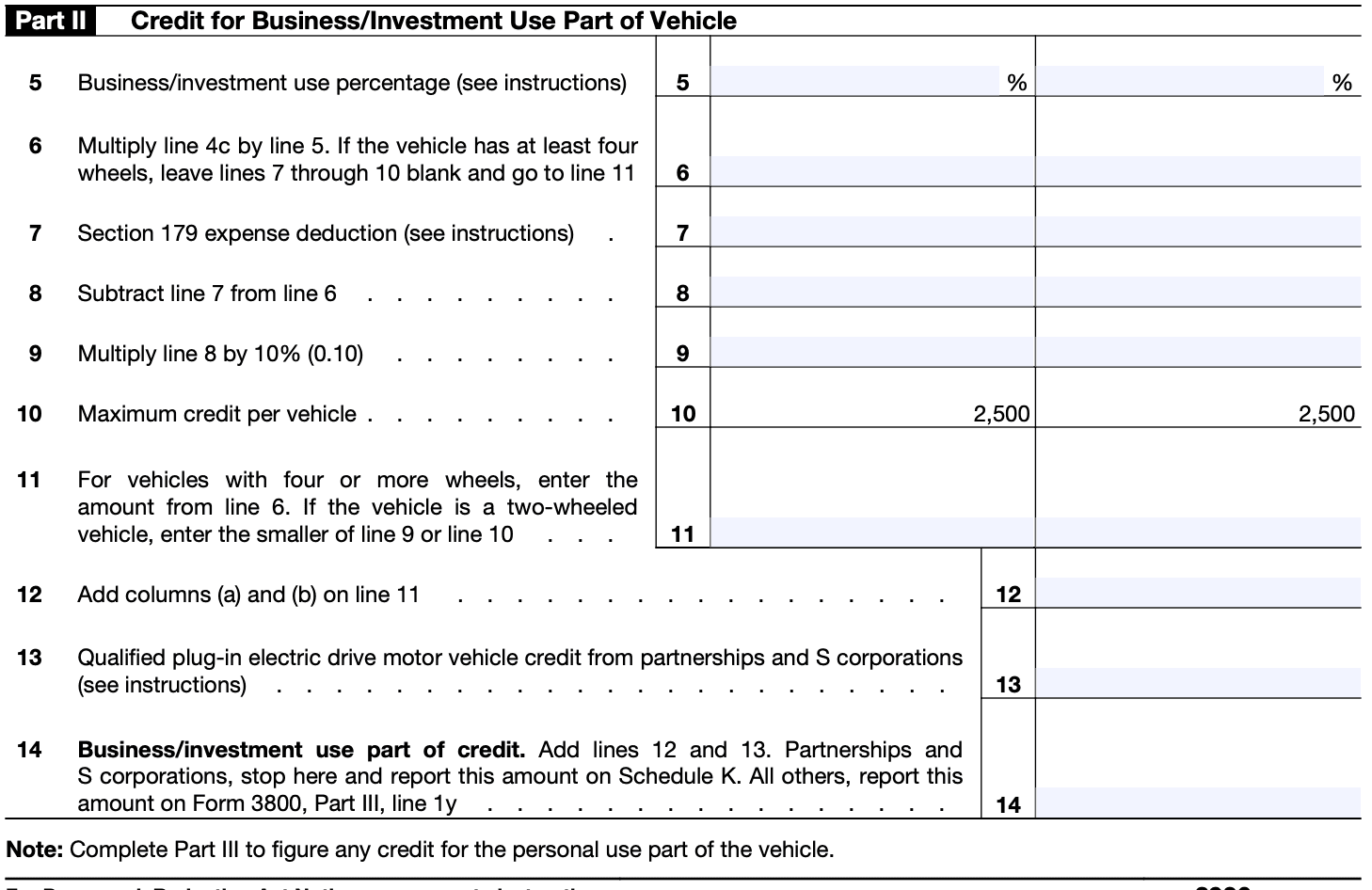

Schedule A Form 8936This document provides a step-by-step walkthrough of how to fill out Form 8936 to receive elective pay for the Commercial. Clean Vehicle Tax Credit. Applicants ... Use Form 8936 to figure your credit for clean vehicles you acquired and placed in service during your tax year Also use a separate Schedule A

How do I generate Form 8936 Qualified Plug-in electric Drive Motor Vehicle credit in Individual tax using Worksheet View w in CCH® ProSystem fx® Tax and CCH ... IRS Form 8936 for Clean Vehicle Credit - Schedule K-1 from Partnership Investment - YouTube IRS Schedule 3 Form 1040 or 1040-SR ≡ Fill Out Printable PDF Forms

Free SCHEDULE A Form 8936 Clean Vehicle Credit Instructions

IRS Form 8936 walkthrough (Clean Vehicle Credits) - YouTube

This article will help you generate Form 8936 in any tax module If the information is for a passthrough or business activity you need to indicate this in the IRS Form 8936 Instructions - Qualifying Electric Vehicle Tax Credits

Form 8936 is the official IRS form used to claim the Qualified Plug In Electric Drive Motor Vehicle Credit or the new Clean Vehicle Credit Form 8936 Delay : r/hrblock 8936 - Qualified Plug-in Electric Drive Motor Vehicle Credit – UltimateTax Solution Center

Tax Form Annotations

IRS Form 8936 walkthrough ARCHIVED COPY - READ COMMENTS ONLY - YouTube

Form 8936: Qualified Commercial Clean Vehicle Credit

IRS Form 8936 Instructions - Qualifying Electric Vehicle Tax Credits

Tax Forum 8936 | Tesla Motors Club

IRS Form 8936 Instructions - Qualifying Electric Vehicle Tax Credits

The Ultimate Guide to Understanding and Applying IRS Form 8936

IRS Form 8936 Instructions - Qualifying Electric Vehicle Tax Credits

H&R Block vs TurboTax vs other Questionnaire For Claiming the $7500 Federal Tax Plug-in Electric Vehicle Credit + POLL | BMW i4 Forum

Commercial Clean Vehicle Tax Credit (45W) Annotation – Climate Program Portal