Schedule 3 Tax Form Trying to find a method to stay arranged? Free printable schedules are the best service! Whether you require a daily, weekly, or monthly planner, these templates assist you simplify jobs, manage your time, and increase performance. Created for flexibility, they're ideal for work, school, or home usage. Simply download, print, and begin planning your days with ease.

With adjustable options, free printable schedules let you tailor your plans to fit your unique requirements. From colorful styles to minimalist layouts, there's something for everybody. They're not only useful however also a budget-friendly method to monitor visits, deadlines, and objectives. Get started today and experience the distinction an efficient schedule can make!

Schedule 3 Tax Form

Schedule 3 Tax Form

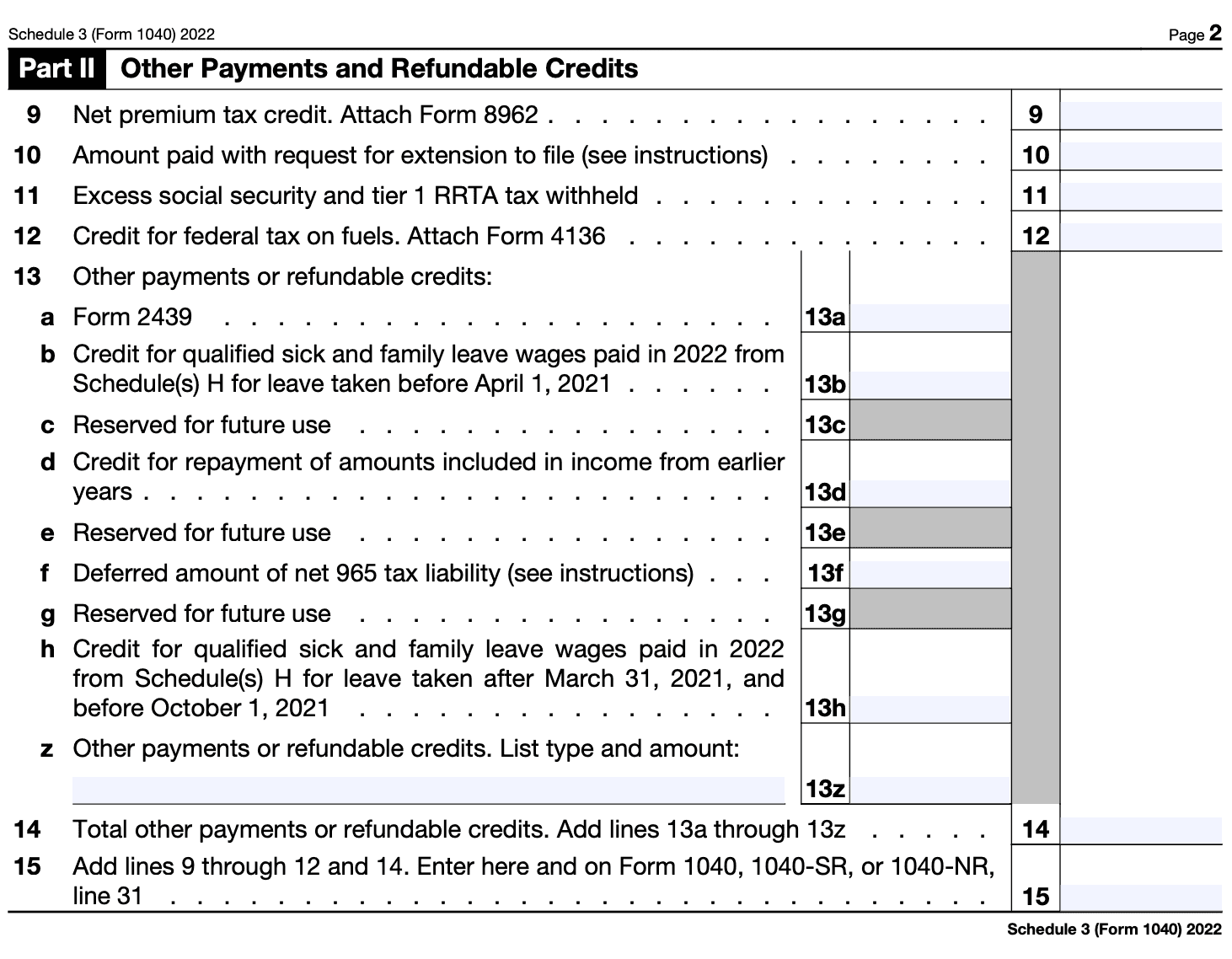

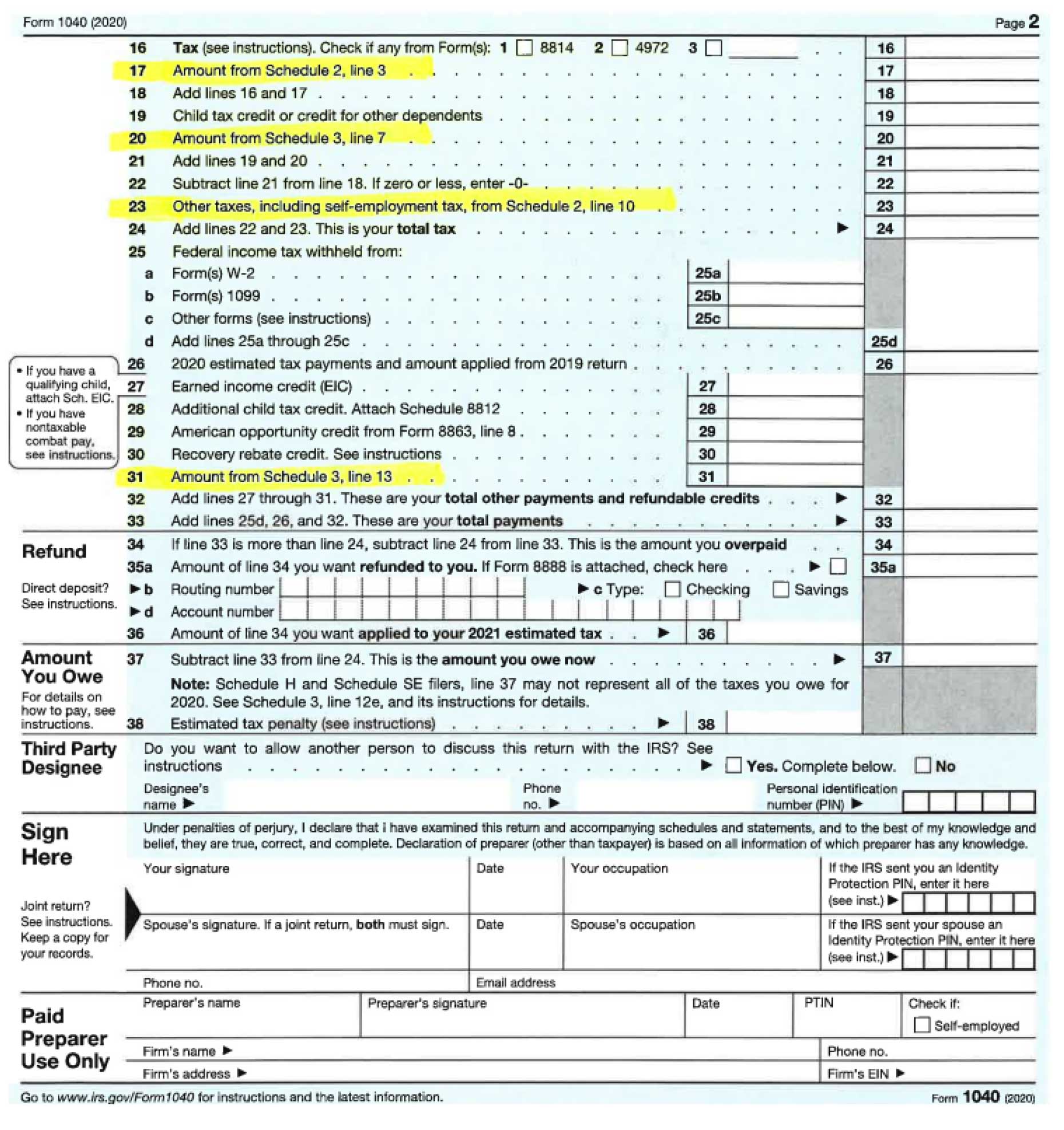

Form 1040 Schedule 3 which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill The newly revised Schedule 3 will be attached to the 1040 Form or the new 1040-SR Form if entries are made on Schedule 3 which include Nonrefundable Credits.

IRS Schedule 1 2 and 3 Austin Peay State University

1040SCHED3 - Form 1040 Schedule 3 Additional Credits & Payments (Page 1 & 2) - NelcoSolutions.com

Schedule 3 Tax FormSchedule 3 is a supplemental form associated with Form 1040 that U.S. taxpayers use to report non-refundable tax credits beyond the basic child tax credit or ... This is an early release draft of an IRS tax form instructions or publication which the IRS is providing for your information Do not file draft forms

Schedule 3 (Form 1040) allows taxpayers to claim additional credits and payments. It includes various nonrefundable credits such as the foreign tax credit and ... Complying with new schedules K-2 and K-3 IRS Schedule 3 Instructions - Additional Credits & Payments

What is Schedule 3 TaxSlayer Support

What is IRS Form 1040 Schedule 3?

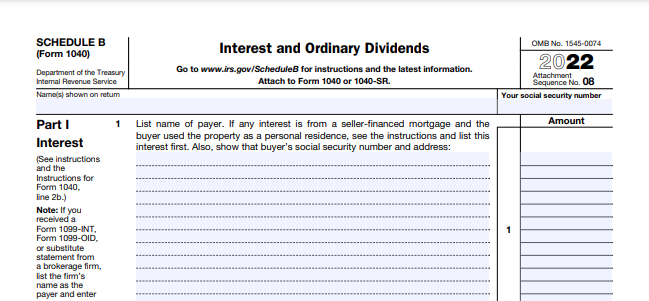

Claim an additional exemption for each dependent child who is a son stepson daughter stepdaughter and or foster child Examples of Tax Documents | Office of Financial Aid | University of Colorado Boulder

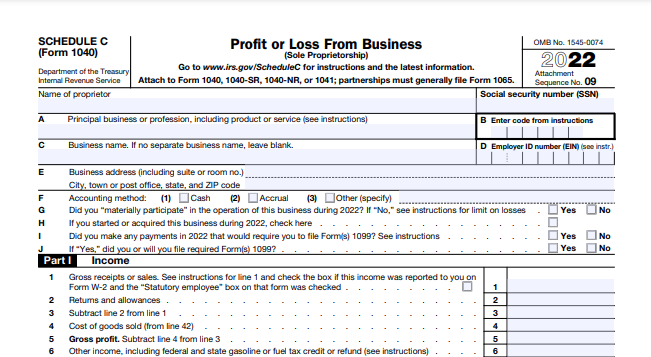

Schedule 3 Form 1040 is used to claim any credit that you didn t claim on Form 1040 or 1040 SR Originally published by irs gov Schedule C (Form 1040) 2023 Instructions Glen Birnbaum on X: "Here is the draft Schedule 3 https://t.co/HuU1rgjN0H showing line 12e, SE tax deferral https://t.co/F0sBobMTZr" / X

IRS Schedule 3 walkthrough (Additional Credits & Payments) - YouTube

IRS Schedule 3: Find 5 Big Tax Breaks Here

2024 Schedule 3 Form and Instructions (Form 1040)

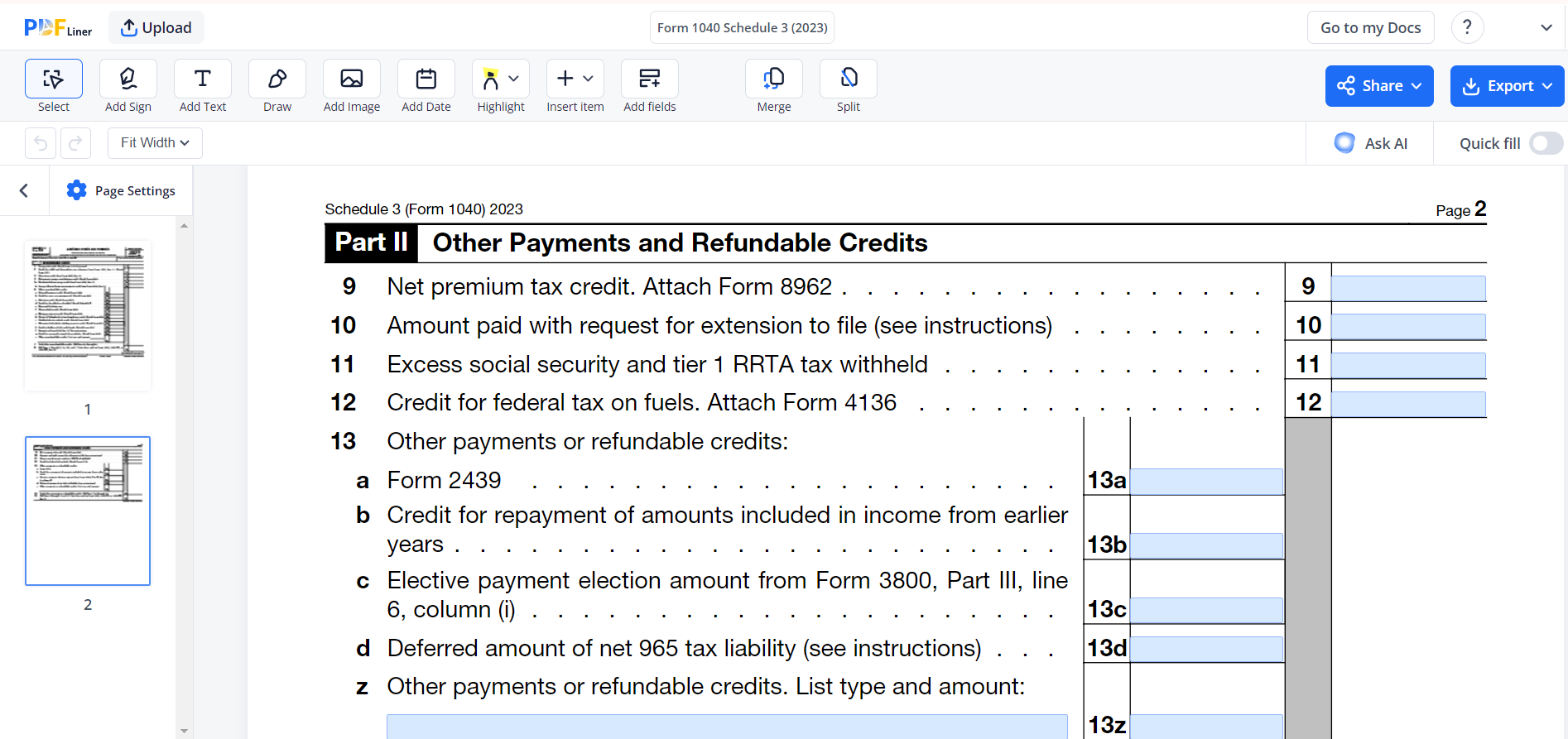

Form 1040 Schedule 3, fill and sign online | PDFliner

2020 Schedule Example | Student Financial Aid

How to Quickly Fill Out Form 1040 Schedule 3

What is IRS Form 1040 Schedule 3?

Examples of Tax Documents | Office of Financial Aid | University of Colorado Boulder

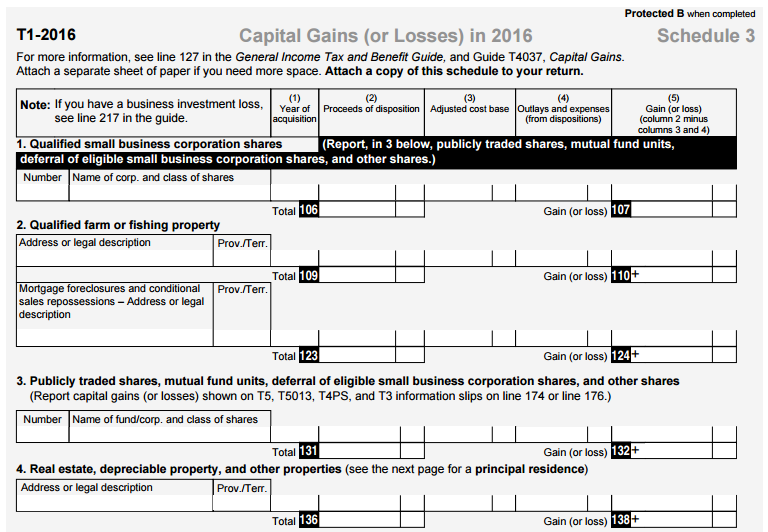

Reporting Capital Gains Schedule 3 - Tax Forms

IRS Releases Form 1040 For 2020 Tax Year | Taxgirl #