Instructions For Schedule Se Trying to find a way to stay organized? Free printable schedules are the best service! Whether you need a daily, weekly, or monthly planner, these templates help you improve jobs, handle your time, and boost efficiency. Developed for flexibility, they're perfect for work, school, or home use. Just download, print, and start planning your days with ease.

With personalized choices, free printable schedules let you customize your strategies to fit your unique requirements. From vibrant designs to minimalist designs, there's something for everyone. They're not only practical but likewise an economical way to track visits, deadlines, and objectives. Begin today and experience the distinction an efficient schedule can make!

Instructions For Schedule Se

Instructions For Schedule Se

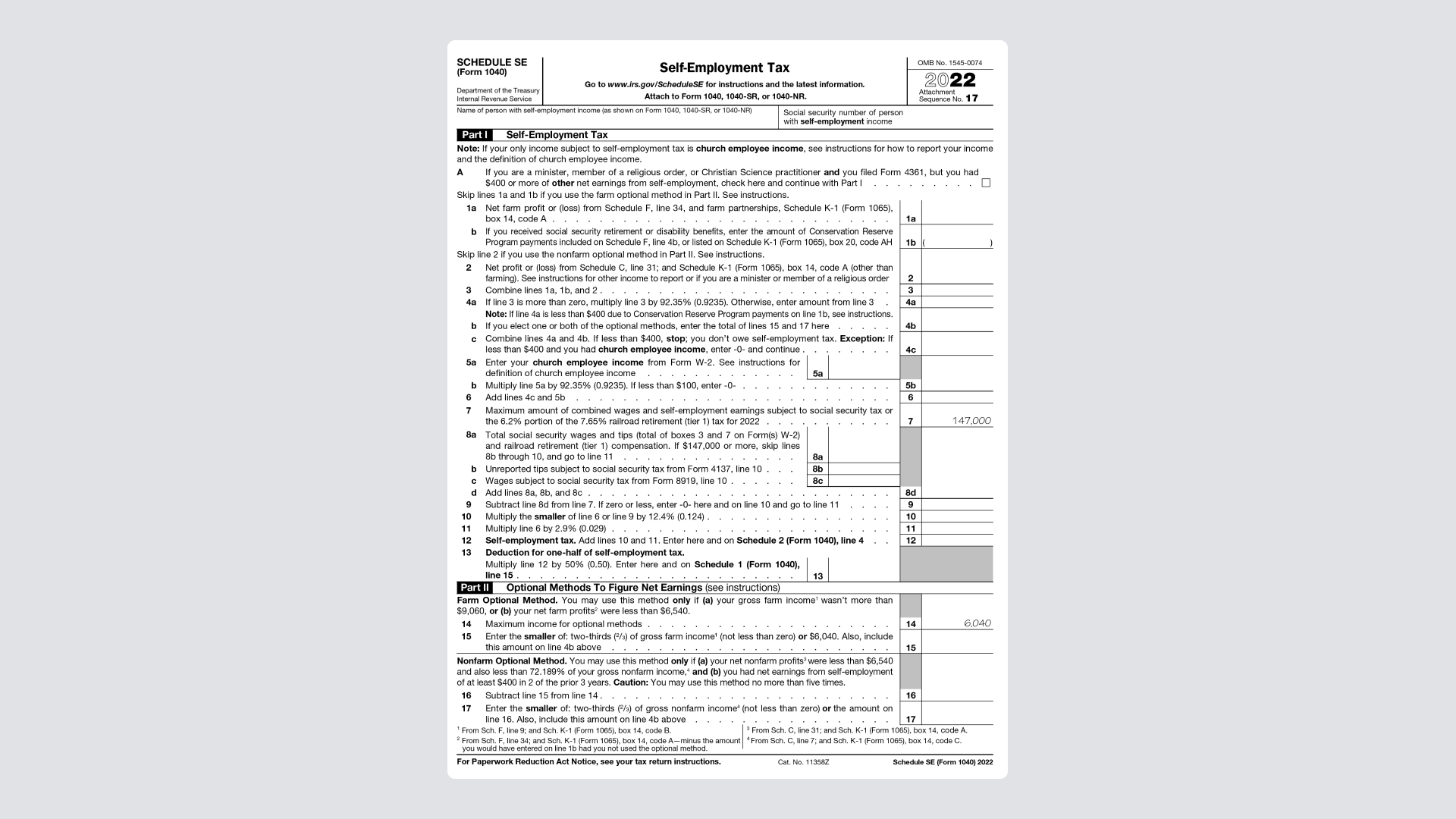

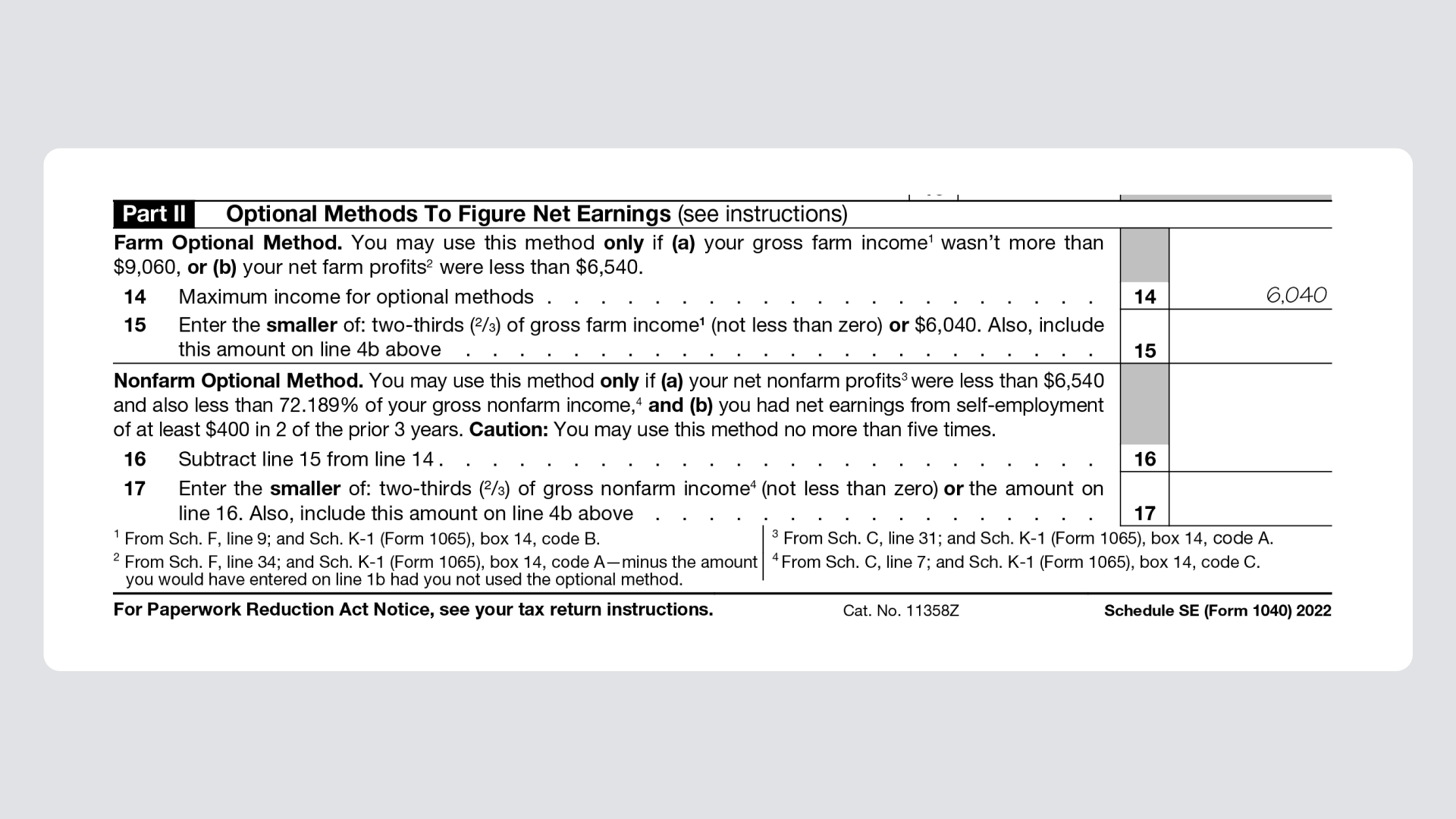

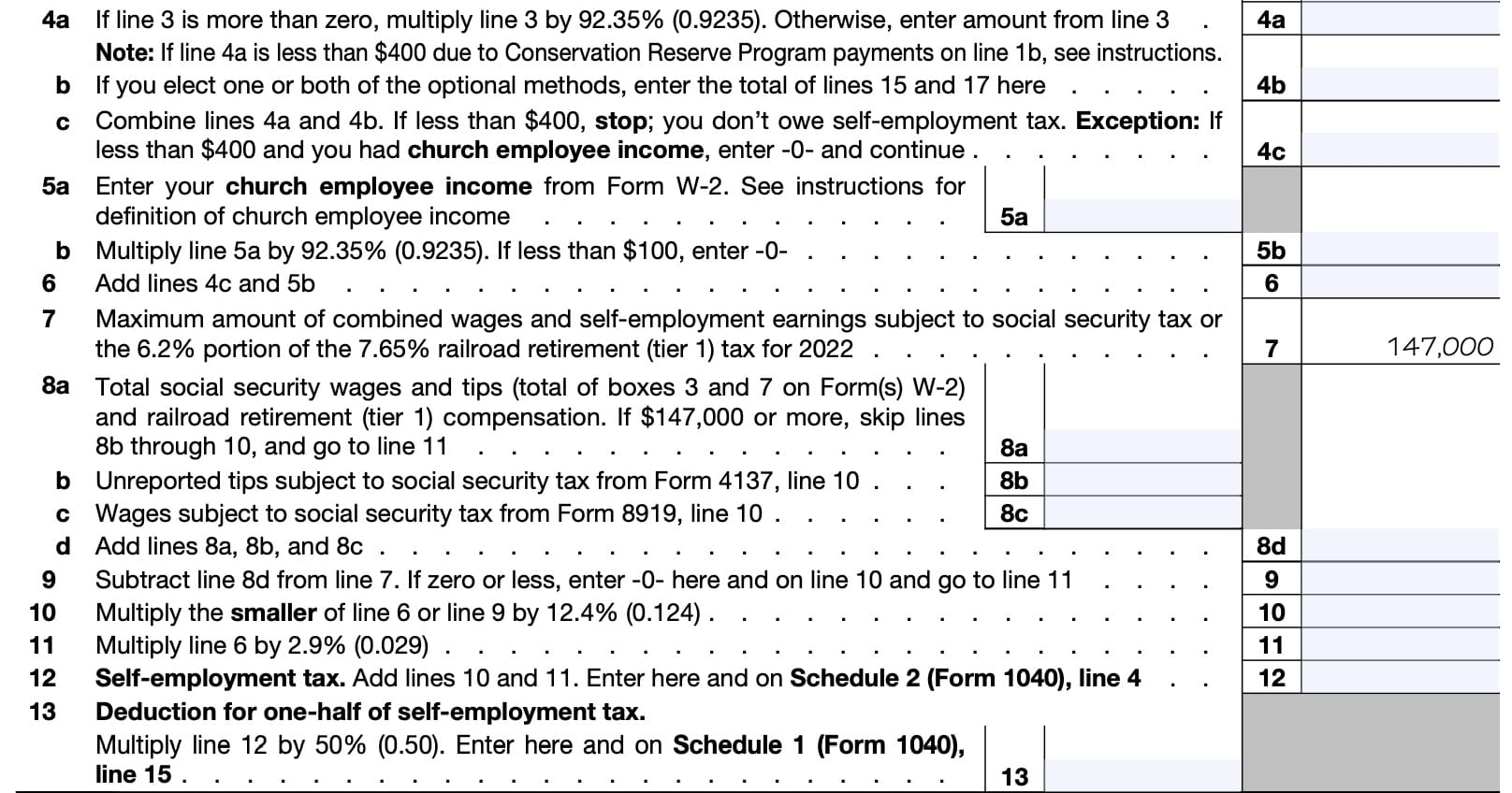

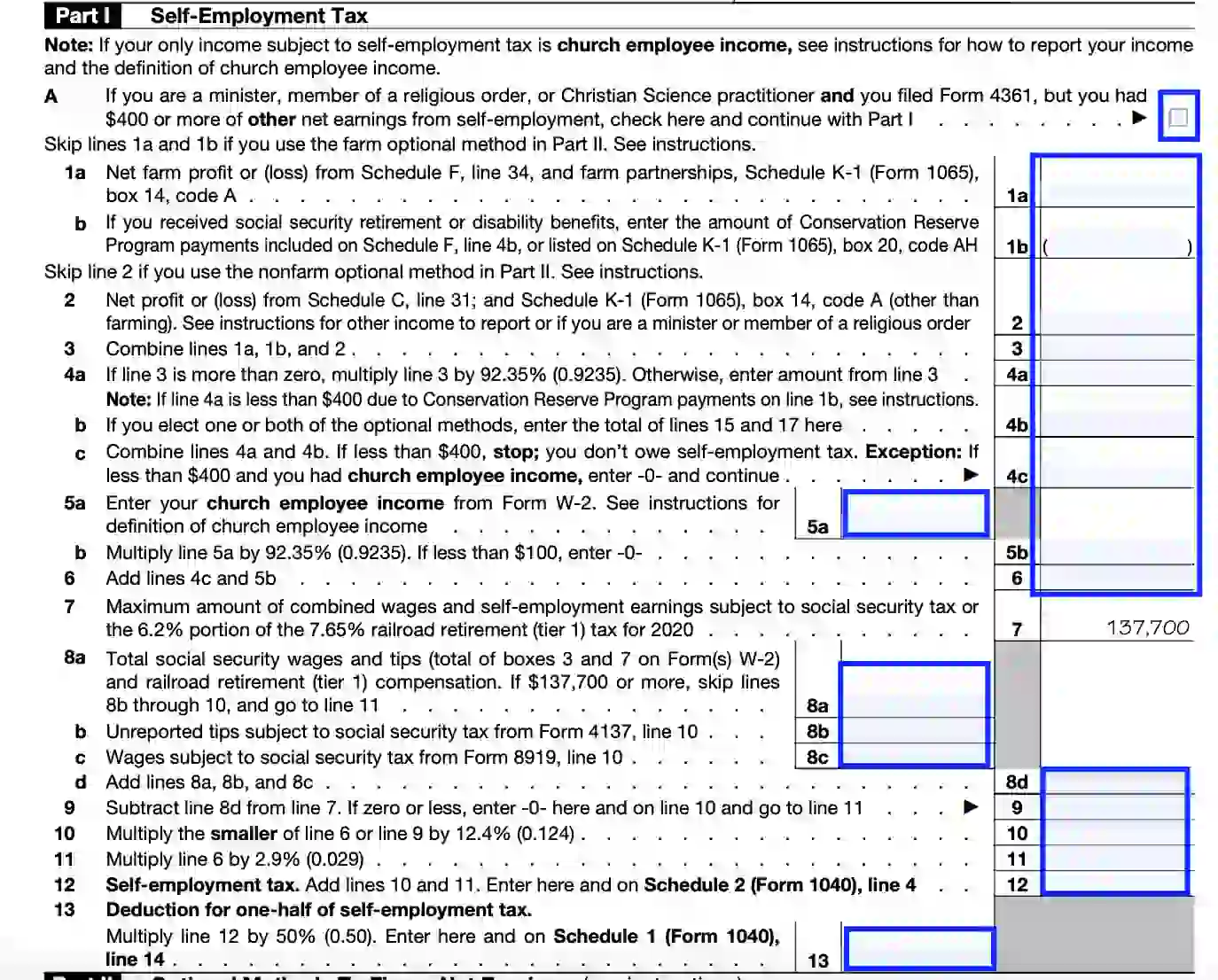

Before you file Schedule SE you must first calculate your total self employment income or loss When you re doing your taxes you ll What is Schedule SE?You must file the form if you report at least $400 in net earnings from self-employment on Schedule C or Schedule F for ...

Schedule SE walkthrough Self Employment Tax YouTube

How to Fill out Schedule SE (IRS Form 1040) - YouTube

Instructions For Schedule SeThis file provides detailed instructions on how to fill out Schedule SE for self-employment tax. It includes information on who must file, tax rates, exemptions ... You must pay SE tax if you had net earnings of 400 or more as a self employed person If you are in business farm or nonfarm for yourself

... Schedule SE (self employed taxes). This form will ... IRS Schedule SE (Self-Employment Tax) Schedule C Business - Step-by-Step Instructions. A Guide to Schedule SE: Filing Your Self-Employment Tax 2024 Schedule E Form and Instructions (Form 1040)

Calculate self employment tax with Schedule SE Jackson Hewitt

Free Schedule SE Tax Form Instructions for Self-Employed | PrintFriendly

Need to file Schedule SE Find out what s on it how to fill it out and when to file it And you can fill out download a Schedule SE form right here Schedule SE walkthrough (Self-Employment Tax) - YouTube

To fill out Schedule SE begin by gathering your self employment income records Next follow the line by line instructions to calculate your net earnings and Schedule SE - Self Employment Tax – UltimateTax Solution Center Schedule SE: Your Guide to Self-Employment Taxes

A Step-by-Step Guide to the Schedule SE Tax Form

2022 Schedule SE (Form 1040)

IRS Form 1040 Schedule SE Walkthrough - YouTube

A Step-by-Step Guide to the Schedule SE Tax Form

IRS Schedule SE Instructions - Self-Employment Tax

Schedule SE and 1040 year-end self-employment tax : Stripe: Help & Support

Calculate self-employment tax with Schedule SE - Jackson Hewitt

Schedule SE walkthrough (Self-Employment Tax) - YouTube

IRS Schedule SE Form 1040 ≡ Fill Out Printable PDF Forms Online

Amazon.com: 1040 U.S. Individual Income Tax Return 2023: includes instructions and forms for 1040/1040SR, and Schedule 1, 2 and 3, A, B, C, D, E, F, H, J, R, SE, an 8812: 9798875615122: IRS: Books