Instructions For Schedule M 3 Looking for a method to remain arranged? Free printable schedules are the best solution! Whether you require a daily, weekly, or monthly planner, these templates assist you improve tasks, manage your time, and improve productivity. Created for flexibility, they're perfect for work, school, or home usage. Merely download, print, and begin preparing your days with ease.

With customizable alternatives, free printable schedules let you customize your strategies to fit your special needs. From colorful styles to minimalist layouts, there's something for everybody. They're not just practical however likewise a budget-friendly method to track appointments, deadlines, and goals. Start today and experience the distinction an efficient schedule can make!

Instructions For Schedule M 3

Instructions For Schedule M 3

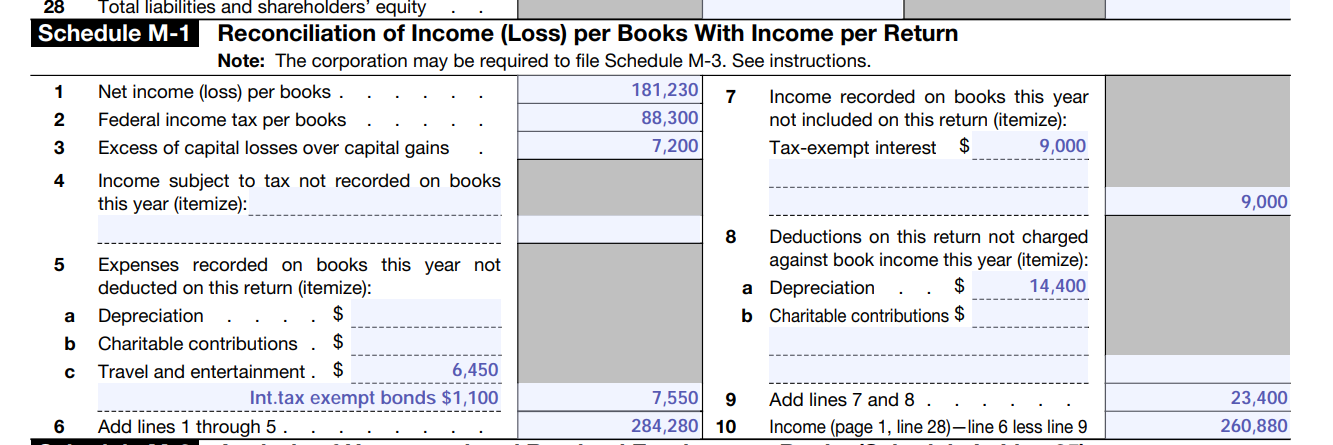

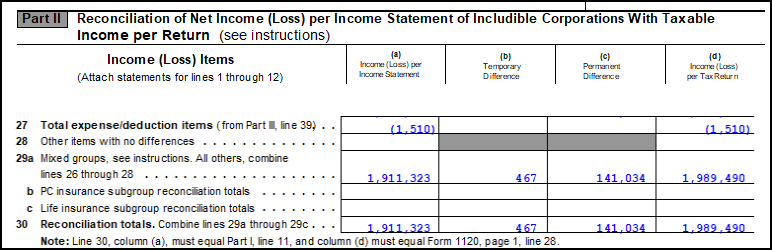

Purpose of Schedule group in order to determine if the group consolidated tax group files Form 1120 Schedule M 3 Part I asks certain Form 1120 Schedule M-3 FAQs on this page are organized to correspond with sections and line items described in the instructions for Schedule M-3.

Information about Schedule M 3 Intuit ProConnect

SOLUTION: Schedule M 3 Completed 1 - Studypool

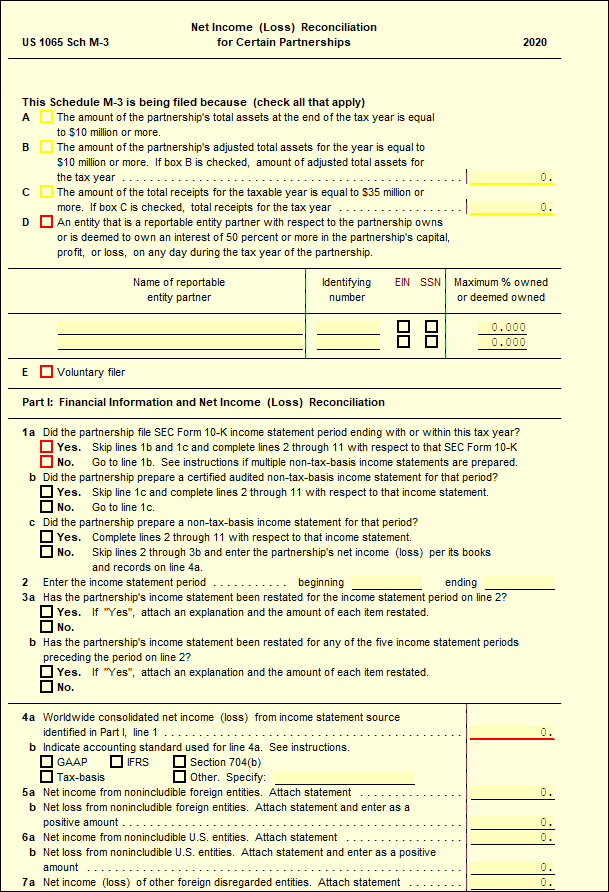

Instructions For Schedule M 3Any entity that files Form 1065 must file Schedule M-3 (Form 1065) if any of the following is true. A common trust fund or foreign partnership must file ... For insurance companies included in the consolidated U S income tax return see the instructions for Part I lines 10 and 11 and Part II line 7 for guidance

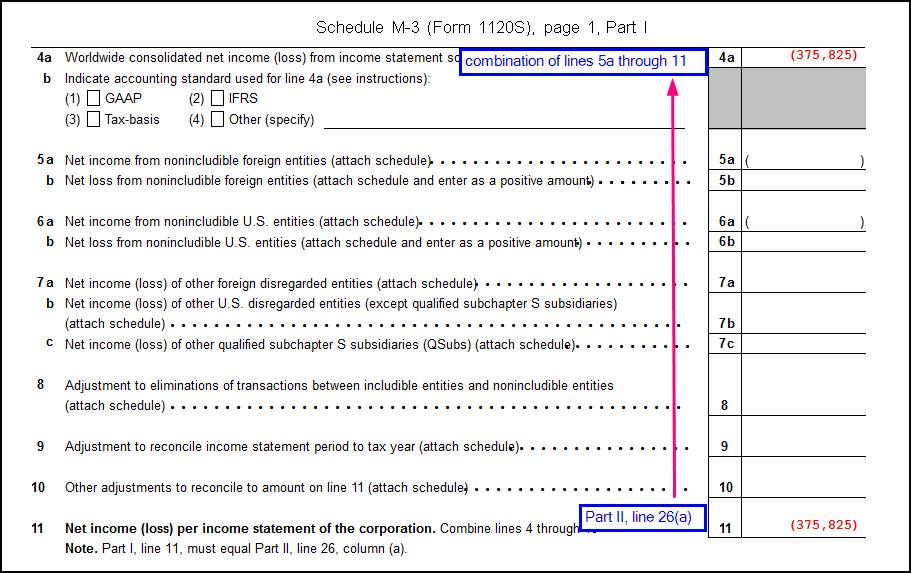

All columns must be completed for any part of Schedule M-3 that is filed. All applicable questions must be answered, all numerical data requested must be ... Drake Tax - 1120-S - Calculating Book Income, Schedule M-1 and M-3 Instructions for filing Form 1120-S: US Income Tax Return for an S Corporation | Lendstart

IRS Issues FAQs for Form 1120 Schedule M 3 Tax Notes

Instructions for Schedule M-3 (Form 1120-F)

If the total assets at the end of the corporation s tax year equal or exceed 10 million the corporation must file Schedule M 3 A corporation Solved 1. In this assignment, please help with Schedule M-1 | Chegg.com

Line 1 or credit net of elimination entries for Any domestic corporation or U S Check the financial statement type intercompany transactions between Untitled M-3 Schedule: Net Income Reconciliation for Corporations — Vintti

Drake Tax - 1120: Calculating Book Income, Schedule M-1 and M-3

Schedule M-3 Form 1065 Explained - YouTube

Schedule M-3 (1065) - Net Income (Loss) Reconciliation for Partnerships – UltimateTax Solution Center

Drake Tax - 1120-S - Calculating Book Income, Schedule M-1 and M-3

Form 1120s Instructions - How to File S Corp Taxes & Maximize Deductions | White Coat Investor

IRS Releases Draft Instructions for Schedules M-3

PDF) 2015 Form 1120 (Schedule M-3 | Tien Tran - Academia.edu

Solved 1. In this assignment, please help with Schedule M-1 | Chegg.com

What is the purpose of Schedule M-1 on Form 1120? - YouTube

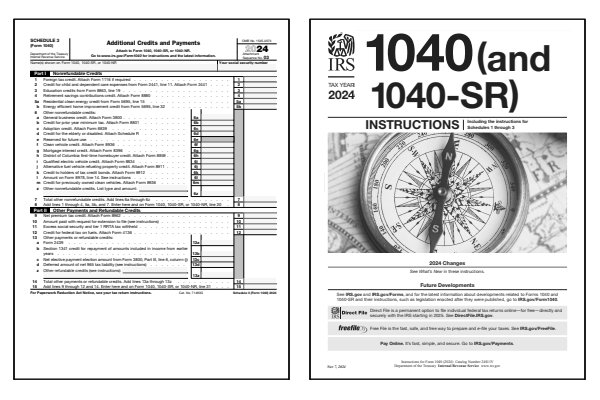

2024 Schedule 3 Form and Instructions (Form 1040)