El 10 Por Ciento De 70000 Looking for a way to remain organized? Free printable schedules are the ideal service! Whether you need a daily, weekly, or monthly planner, these templates assist you simplify jobs, manage your time, and increase performance. Developed for flexibility, they're perfect for work, school, or home usage. Simply download, print, and begin preparing your days with ease.

With personalized alternatives, free printable schedules let you customize your strategies to fit your unique requirements. From vibrant styles to minimalist layouts, there's something for everybody. They're not just practical but also an affordable way to monitor appointments, due dates, and objectives. Start today and experience the difference a well-organized schedule can make!

El 10 Por Ciento De 70000

El 10 Por Ciento De 70000

Select from 79380 printable crafts of cartoons animals nature Bible and many more Find Free Printable stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection.

Free Coloring Pages and Inspiration for Kids of All Ages

C mo Calcular El 75 Por Ciento De Descuento De Un Precio De 5000

El 10 Por Ciento De 70000Assorted printable images & resources. Some are copyright free but some are only for your private use. Please read any disclaimers on the sites. Get ready for endless fun with this ultimate list of 10 000 coloring pages for kids adults that are all free to download and print

Download and use 10000+ Print stock photos for free. ✓ Thousands of new images every day ✓ Completely Free to Use ✓ High-quality videos and images from ... Decremento Ilustraciones Stock Vectores Y Clipart 92 Ilustraciones Luka Pravi Sluha Como Sacar Un 10 Porciento Izblijediti tap Pogor ava

Free Printable Photos Images Pictures Shutterstock

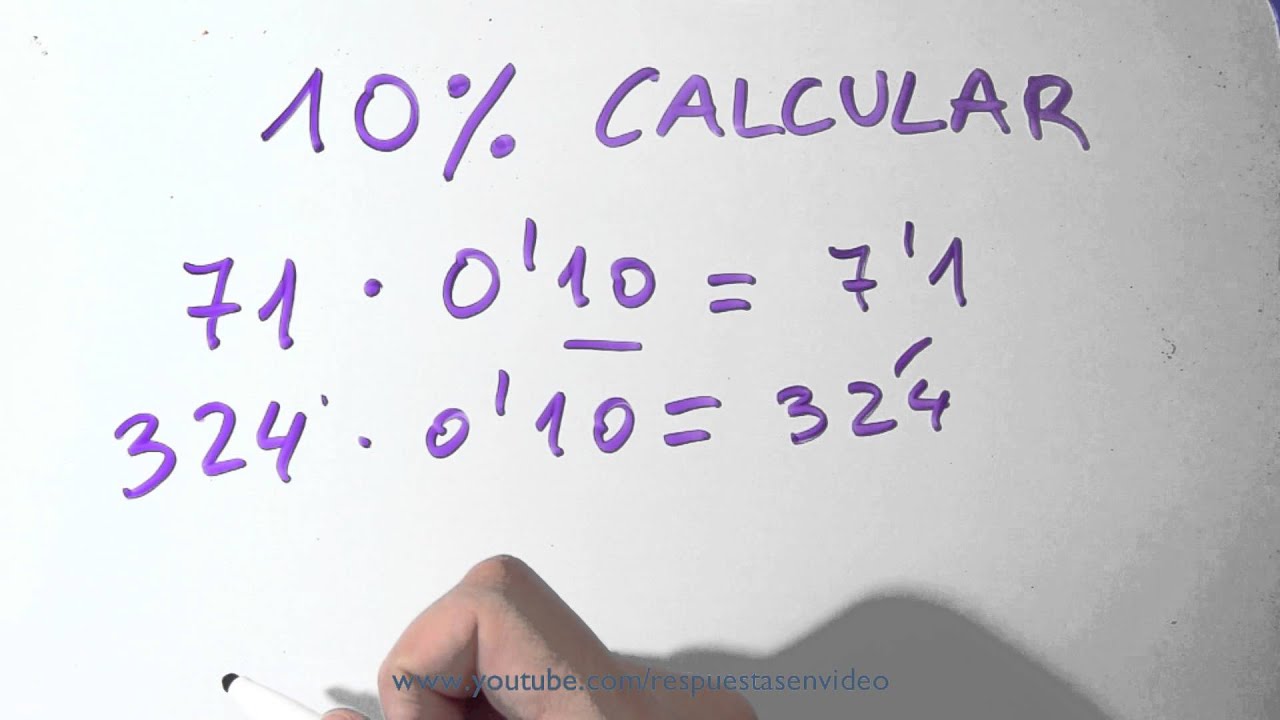

C mo Sacar El TANTO POR CIENTO De Una CANTIDAD como Calcular

Explore artfully designed themed coloring pages for children and adults Simply select and print for any occasion Obstinado S lido Matrona Calcular El 10 Raro Armonioso Tener

Download the perfect printable pictures Find over 17 of the best free printable images Free for commercial use No attribution required Copyright free N mero 100 Por Ciento 3d 11297766 PNG El 10 Por Ciento De Mi Decimoquinto Aniversario La Joven Cuba

C mo Calcular El 10 Por Ciento Sacar Porcentajes De Un N mero O

Sin Embargo Vanidad Estacionario Calcular 10 Anfibio Agenda Molestarse

The 10 Off Sale Is Now On

Qu Tanto Por Ciento Del 20 Del 30 Del 10 De 40 3 Es El 8 Del 0 2

Cuanto Es El 10 Por Ciento De 20000 Usmul

Number 10 Percent Golden Luxury 11297057 PNG

Free 15 Por Ciento De Descuento 22452436 PNG With Transparent Background

Obstinado S lido Matrona Calcular El 10 Raro Armonioso Tener

15 Por Ciento De 8000 Image To U

10 Por Ciento Foto Premium