Ca Tax Return Schedule S Searching for a method to remain organized? Free printable schedules are the ideal option! Whether you need a daily, weekly, or monthly planner, these templates help you simplify tasks, handle your time, and boost productivity. Created for versatility, they're ideal for work, school, or home use. Merely download, print, and begin preparing your days with ease.

With personalized alternatives, free printable schedules let you customize your strategies to fit your special requirements. From colorful styles to minimalist designs, there's something for everybody. They're not only useful however likewise an affordable way to monitor visits, deadlines, and goals. Get going today and experience the distinction an efficient schedule can make!

Ca Tax Return Schedule S

Ca Tax Return Schedule S

The Schedule S is an optional filing for Contractors performing work within the city of Fresno In order to be accepted this form must be typed File your California income tax return. All tax brackets are supported. IRS e-file is included, and federal returns are always free.

CA Schedule S Line 7 TurboTax Support Intuit

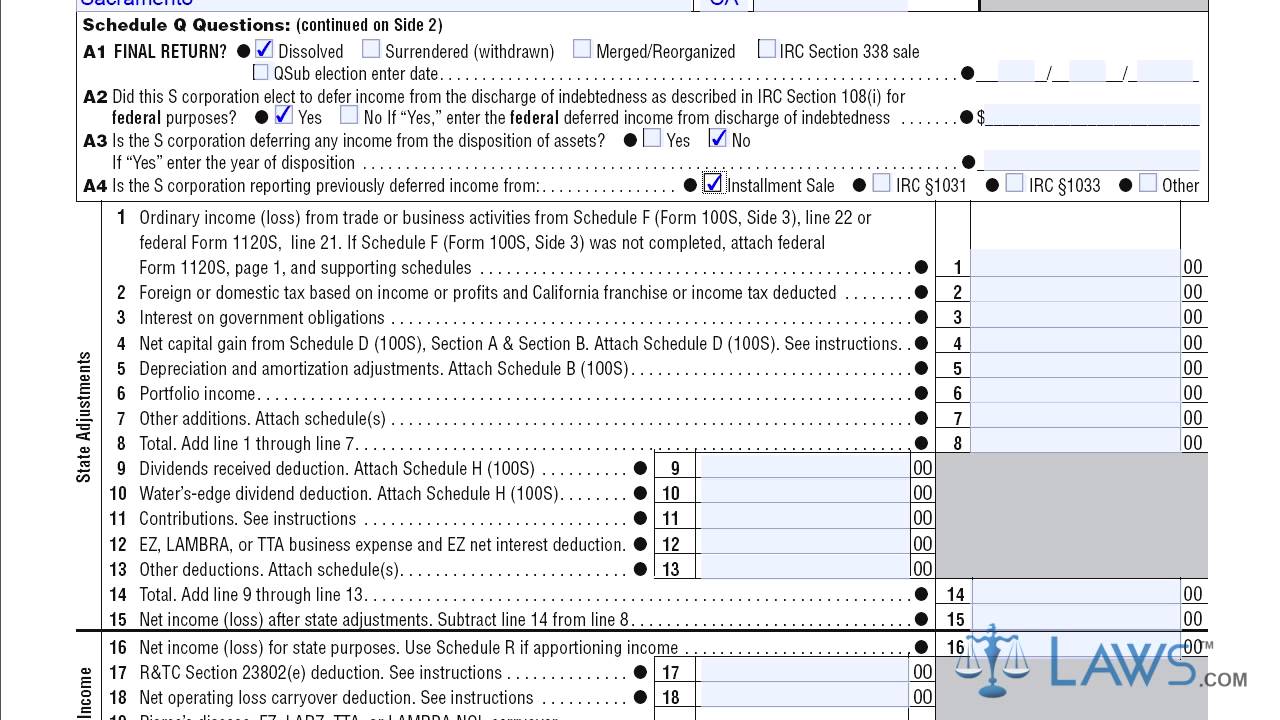

Form 100S California S Corporation Franchise or Income Tax Return - YouTube

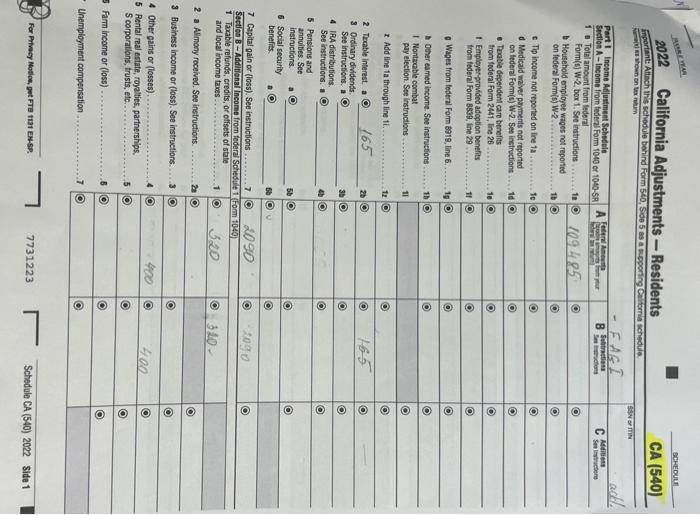

Ca Tax Return Schedule SCalifornia state returns can be filed with the federal return or sent state-only through California's Electronic Filing Program. Schedule S states that a taxpayer is taxed in another state on the same income he is entitled to a tax credit for the tax paid to that other

... taxes for the same income in another state, complete the screen "CA - Schedule S - Other State Tax Credit". This will indicate that these taxes were paid ... State Accepts Payment Plan in Stockton, CA - 20/20 Tax Resolution Tax Subject CA-1 - Filing a California Tax Return

California State Tax Software Preparation and E File on FreeTaxUSA

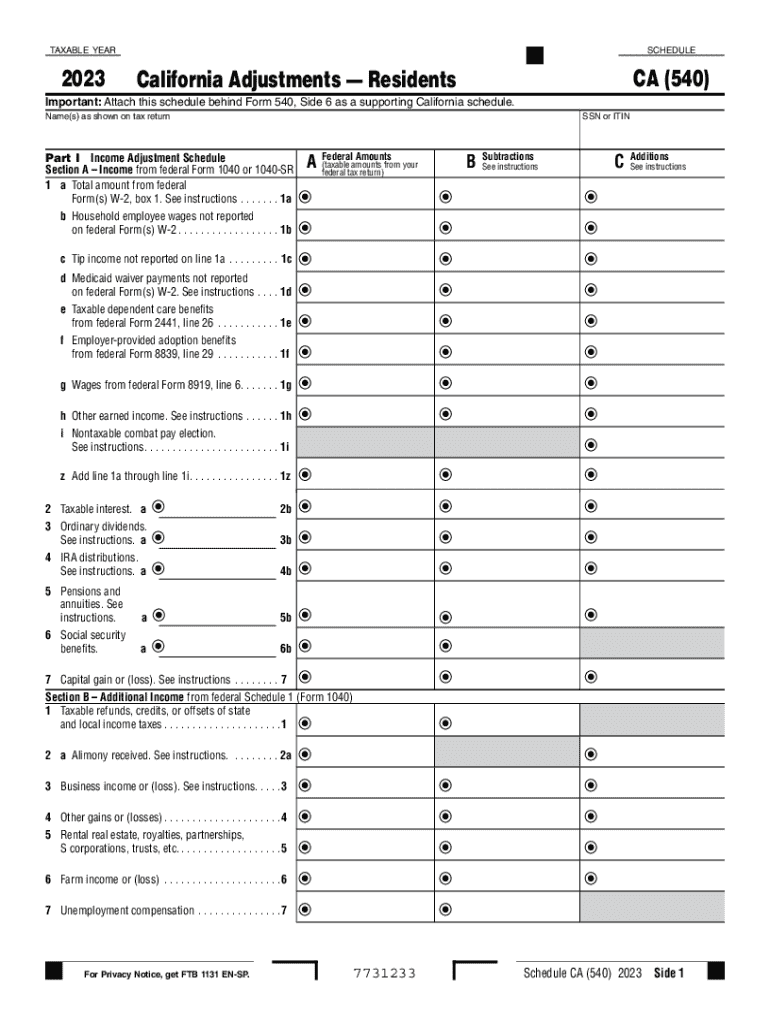

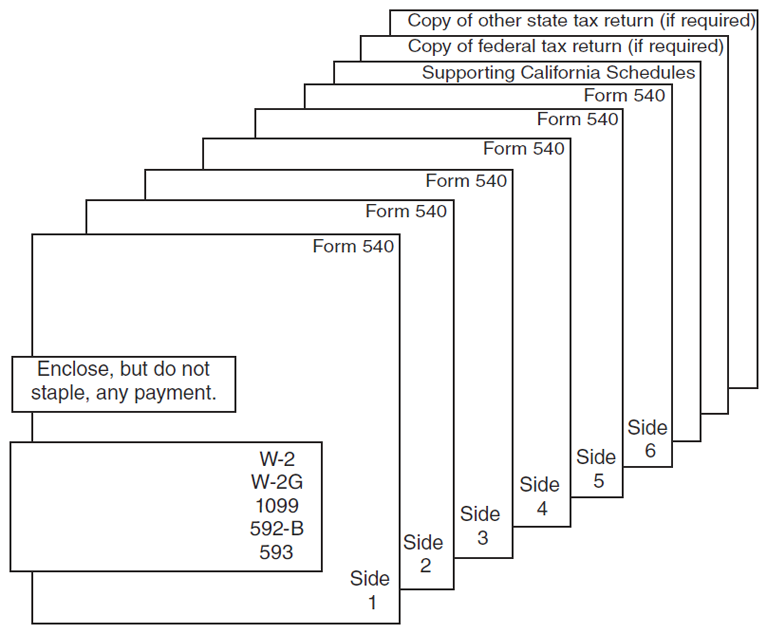

2023 Personal Income Tax Booklet | California Forms & Instructions 540 | FTB.ca.gov

Based on the mechanics of California Schedule S the Franchise Tax Board FTB interprets the term net tax payable to be tax after most credits are utilized Amended tax return California LLC form 568 confusion : r/TurboTax

The tax rate schedules must be used if taxable income is over 100 000 Generally either the tax rate schedules or the tax tables may be used if taxable income Filing 540 Tax Form: California Resident Income Tax Return Has your due date changed? | BFBA, LLP

Solved: California allows itemized deductions on the Schedule CA even if the taxpayer takes the standard deduction on the Federal Return. How can this be done with the software?

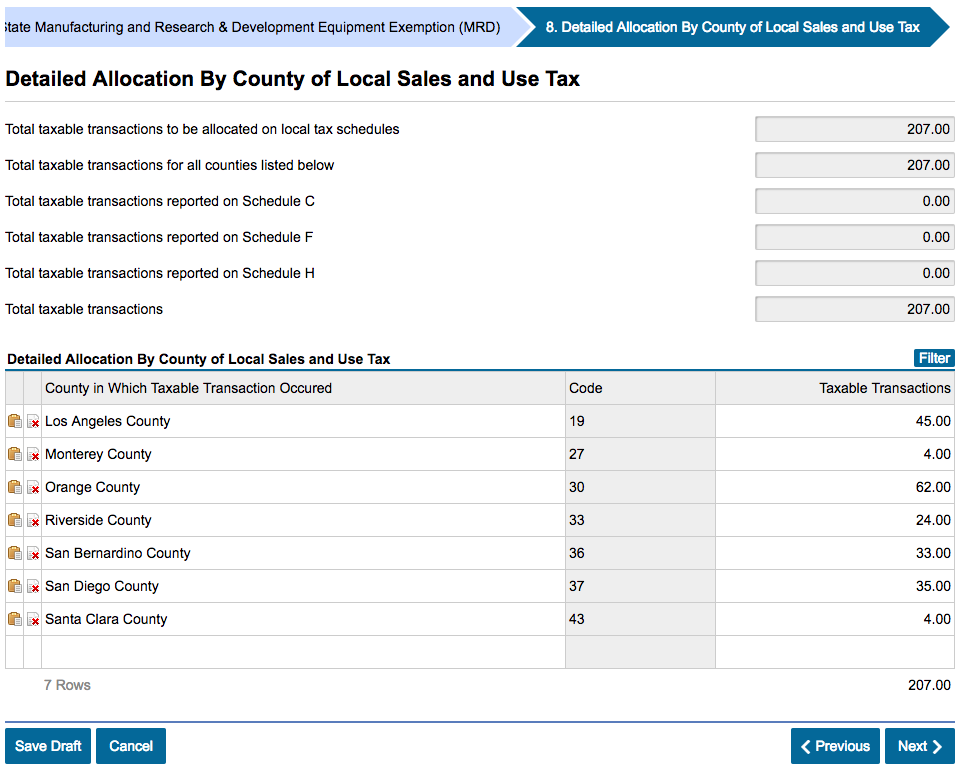

How to File and Pay Sales Tax in California | TaxValet

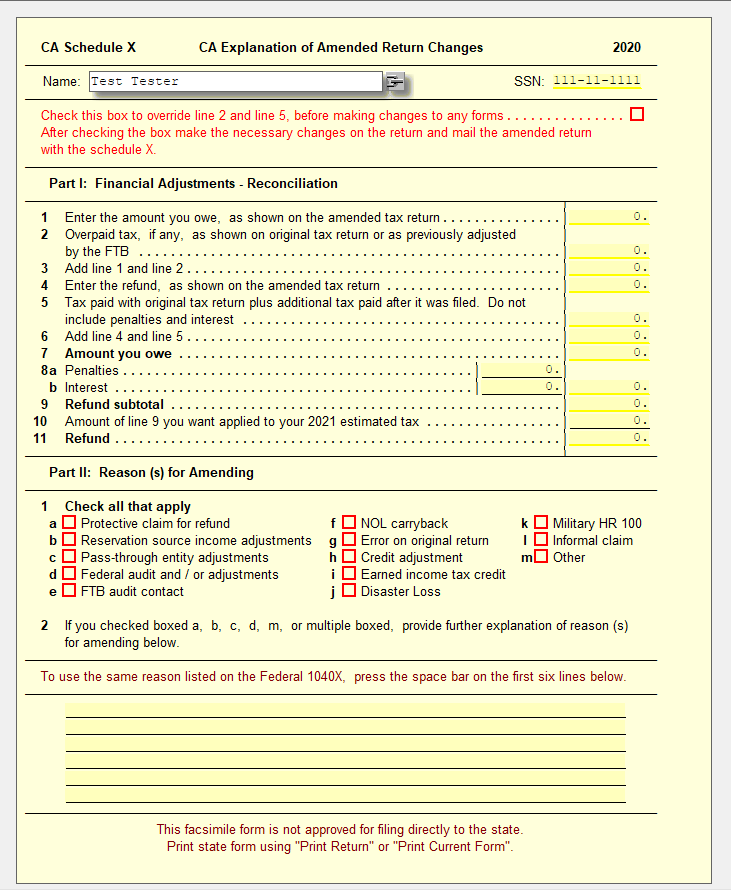

Amended CA Return – UltimateTax Solution Center

California Adjusted Gross Income as a CA nonresident - 540NR

Form 100S California S Corporation Franchise or Income Tax Return - YouTube

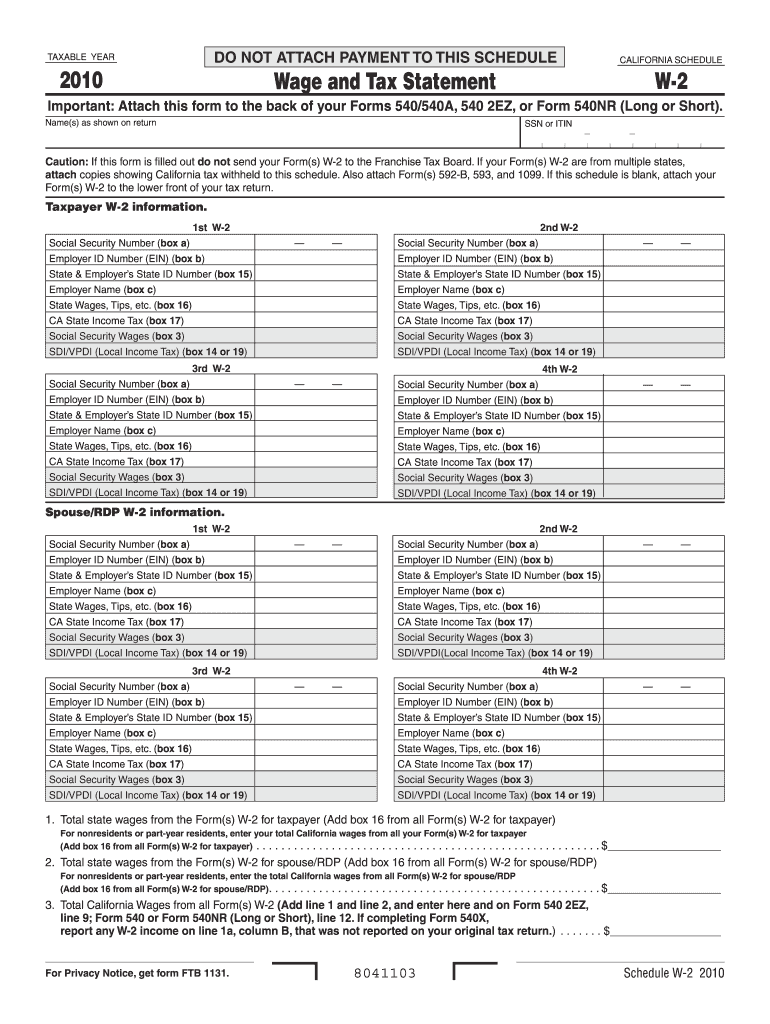

2010-2024 Form CA FTB Schedule W-2 Fill Online, Printable, Fillable, Blank - pdfFiller

2017 Schedule S (540) - Other State Tax Credit Instructions

Amended tax return California LLC form 568 confusion : r/TurboTax

How to file a California sales tax return - TaxJar

Required: Complete the tax return on 2022 Form 540, | Chegg.com