990 Schedule B Searching for a method to remain arranged? Free printable schedules are the perfect option! Whether you require a daily, weekly, or monthly planner, these templates help you streamline jobs, manage your time, and improve productivity. Created for versatility, they're ideal for work, school, or home usage. Merely download, print, and begin preparing your days with ease.

With customizable alternatives, free printable schedules let you customize your strategies to fit your special requirements. From vibrant designs to minimalist layouts, there's something for everyone. They're not just practical but likewise a budget-friendly way to keep track of visits, deadlines, and goals. Start today and experience the distinction an efficient schedule can make!

990 Schedule B

990 Schedule B

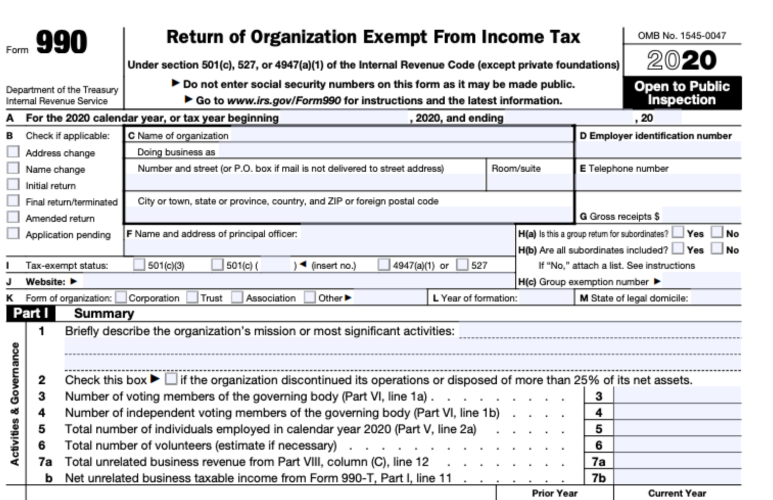

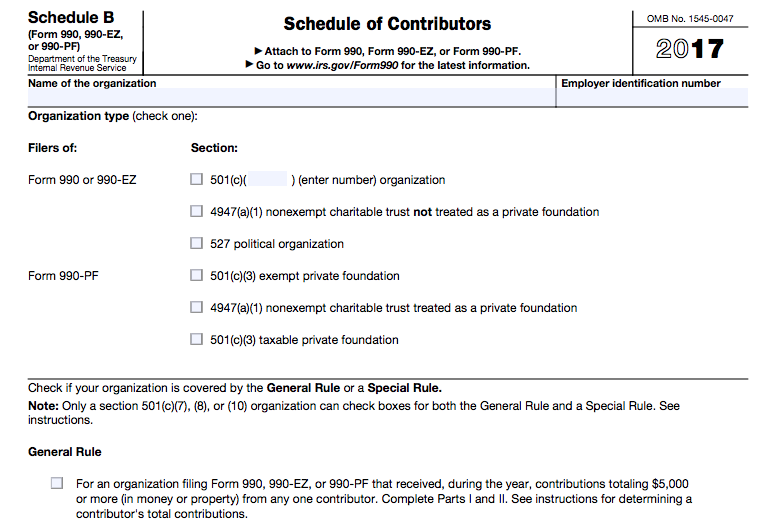

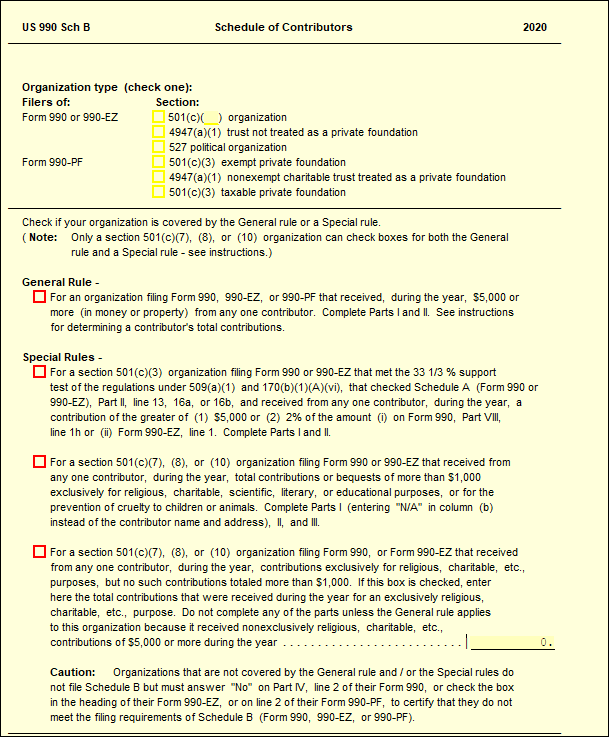

Schedule B Form 990 or 990 EZ is used by organizations required to file Form 990 Return of Organization Exempt From Income Tax or Form 990 EZ Short Form The general rule is marked for any organization that received a contribution greater than or equal to $5,000 from any 1 contributor.

Form 990 schedules with instructions Internal Revenue Service

IRS Dumps Schedule B For Associations, Others NPOs - The NonProfit Times

990 Schedule BSchedule B, Schedule of Contributors is a supplementary schedule filed annually by tax-exempt organizations (Form 990/990-EZ) and private foundations (Form 990- ... Generally a nonprofit organization must file Schedule B with Form 990 if it receives contributions of the greater of 5 000 or more from any one contributor

Whether or not the organization enters any amount on line 1 of Form 990-EZ, the organization must either check the box in item H or attach Schedule B. 2006 Form 990, 990-EZ, or 990-PF (Schedule B) Final Treasury Regulations Address IRS Form 990 Schedule B Donor Disclosure Requirements

Schedule B General and Special rules 990 Thomson Reuters

Schedule B (Form 990) | Fill and sign online with Lumin

IRS Form 990 Schedule B is a supplementary filing requirement of nonprofit organizations used to report details regarding the contributions they received during About Form 990 Schedule B - Tax990

Use Schedule B Form 990 990 EZ or 990 PF to give information on contributions the organization reported on What is Form 990's Schedule B? How Do I File? A Tax990 Guide! - Tax990 Church Law Center U.S. Supreme Court to Decide Case on Schedule B Donor Disclosures - Church Law Center

Final Treasury Regulations Address IRS Form 990 Schedule B Donor Disclosure Requirements

Schedule B (990/EZ/PF) - Schedule of Contributors – UltimateTax Solution Center

Form 990 Schedule B & Donor Disclosures: What's Required?

What is Form 990 Schedule B? - YouTube

Form 990 Schedule B - Donor Disclosure Requirements - Labyrinth, Inc. | www.labyrinthinc.com

How to Complete Schedule B for Form 990/990-EZ

Schedule B (Form 990) | Fill and sign online with Lumin

About Form 990 Schedule B - Tax990

Guide to Form 990 Schedule B for Independent Schools - Smith and Howard

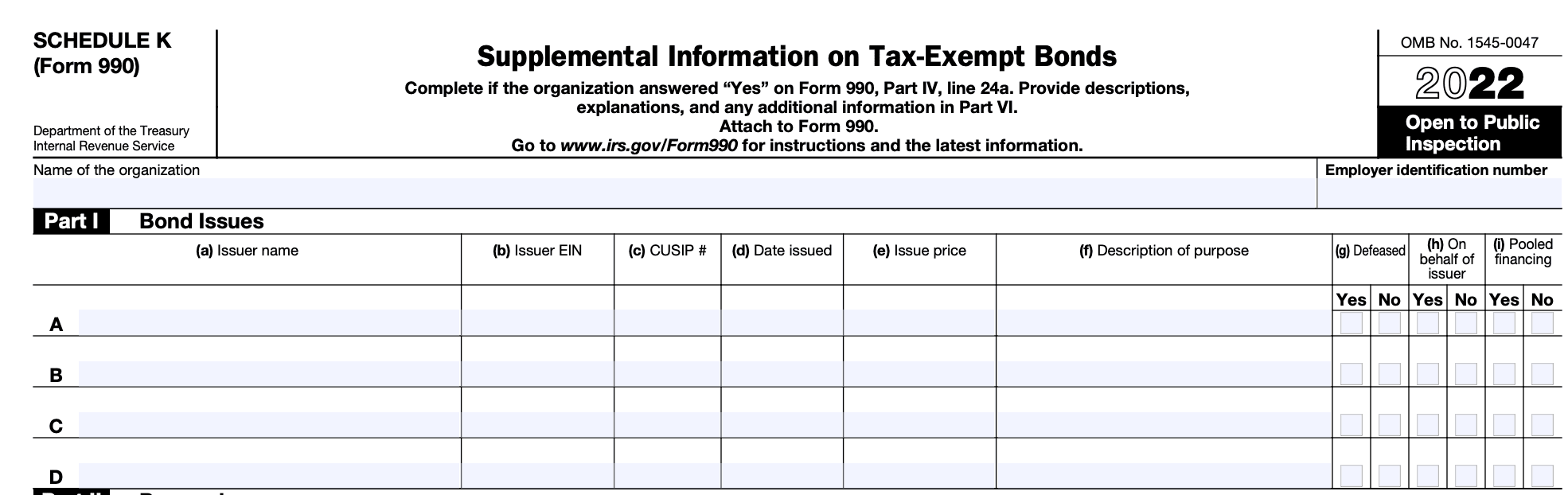

Form 990: Schedule K, Tax-Exempt Bond Details