2 1 2 Divided By 3 4 In Fraction Form Trying to find a method to remain arranged? Free printable schedules are the perfect solution! Whether you need a daily, weekly, or monthly planner, these templates help you improve jobs, handle your time, and boost efficiency. Developed for adaptability, they're perfect for work, school, or home usage. Just download, print, and begin planning your days with ease.

With customizable options, free printable schedules let you customize your strategies to fit your unique requirements. From vibrant styles to minimalist layouts, there's something for everybody. They're not just useful but likewise an affordable way to keep an eye on visits, deadlines, and objectives. Start today and experience the distinction a well-organized schedule can make!

2 1 2 Divided By 3 4 In Fraction Form

2 1 2 Divided By 3 4 In Fraction Form

This is a blank editable BINGO template made in powerpoint Can add a background change font and use for almost any subject or need Here's a set of free printable blank bingo cards for teachers. Print them for your students, and use them to make your own bingo game.

Big Blank Bingo Card Freeology

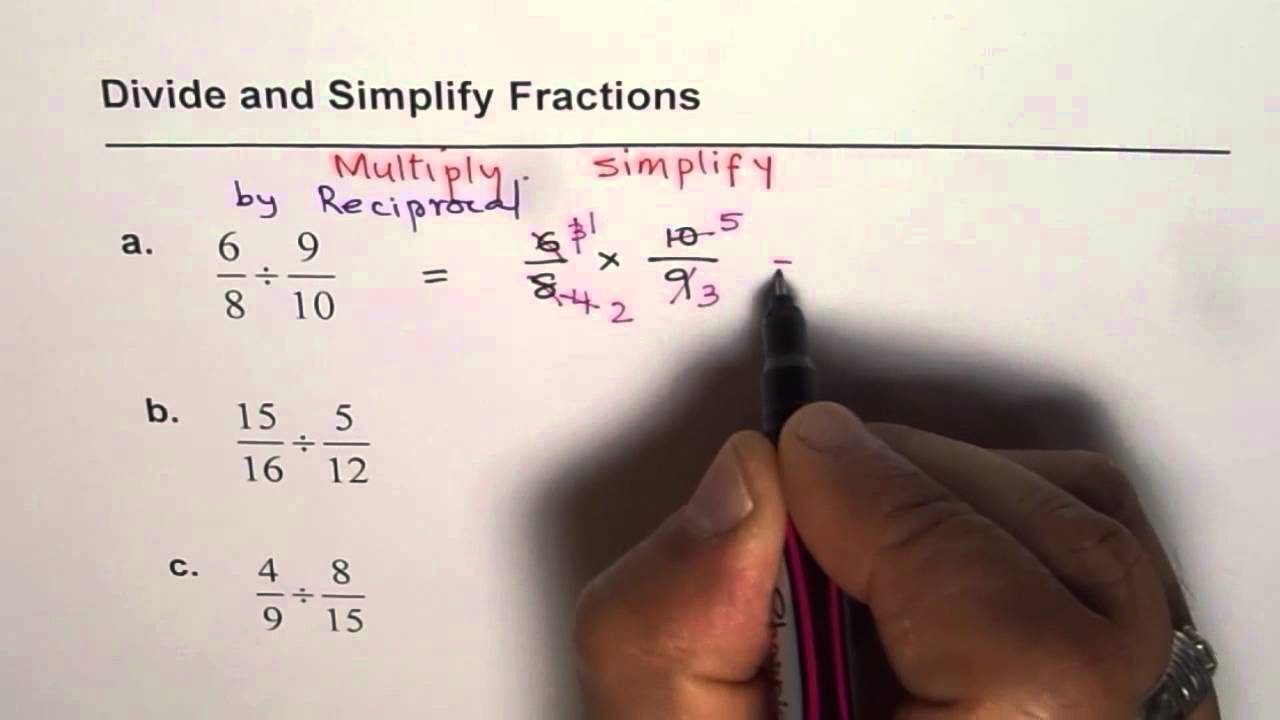

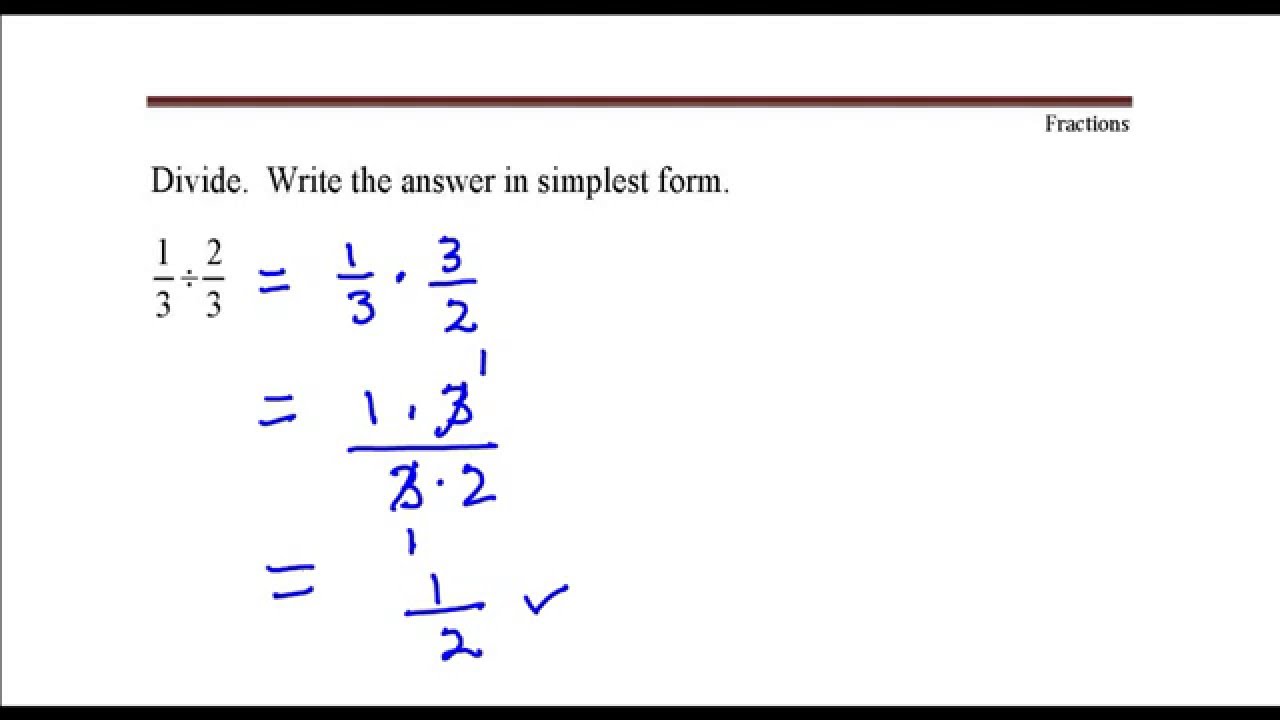

Dividing Fractions 1 2 Divided By 3 YouTube

2 1 2 Divided By 3 4 In Fraction FormCreate randomized bingo cards for free in seconds with our amazing Bingo Card Generator. Print your bingo cards at home to play in‑person, or send out links to ... Bingo Card Templates Make free bingo card templates You can print at home or send out individual bingo cards to play virtual bingo on any device

Blank Bingo Cards Template. There are two bingo boards on this page. Cut this page down the middle to save paper. 10 Divided By 1 2 Blank Division Chart

Printable Blank Bingo Cards for Teachers

4 Divided By 3 4 Four Divided By Three Fourths YouTube

Create your own custom bingo cards with this free blank template Perfect for parties holidays and more Download and print as many as you need 28 Divide By 30

Your customized bingo card template is printable and downloadable Simply download a high resolution JPG PNG or PDF file to your desktop and print it any time 26 500 Divided By 12 8 9 Divided By 8

27 15 Simplified Form

28 Divide 400

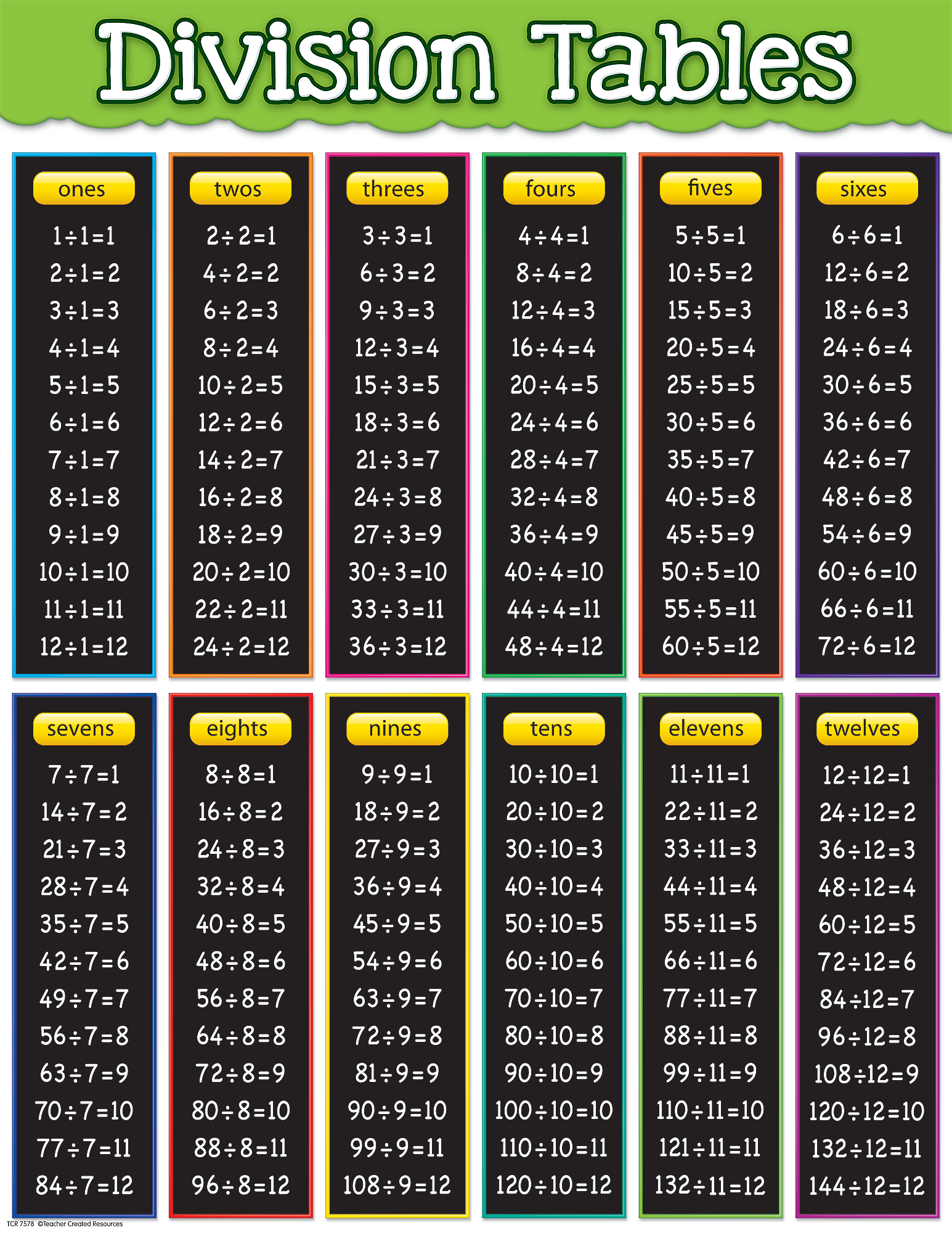

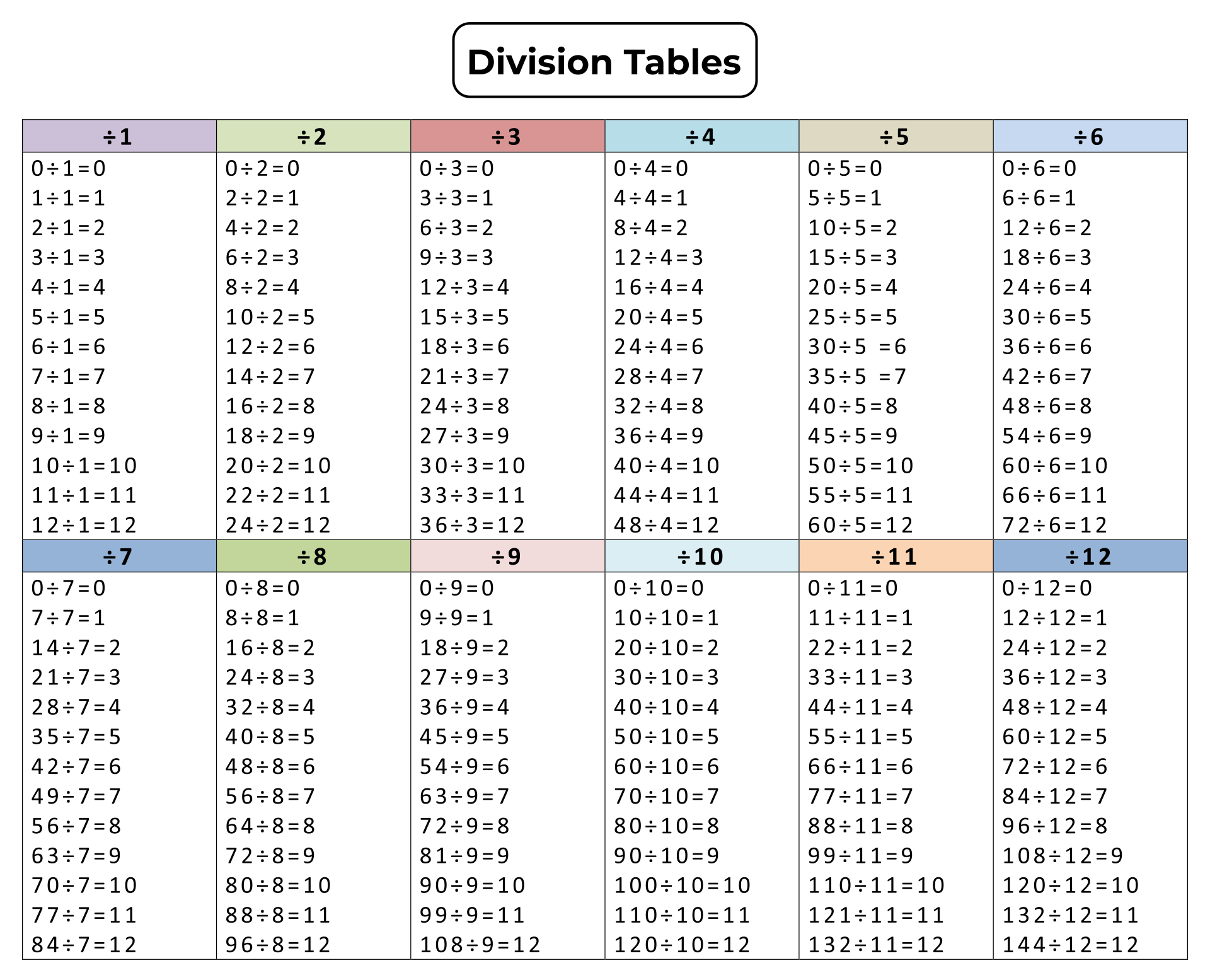

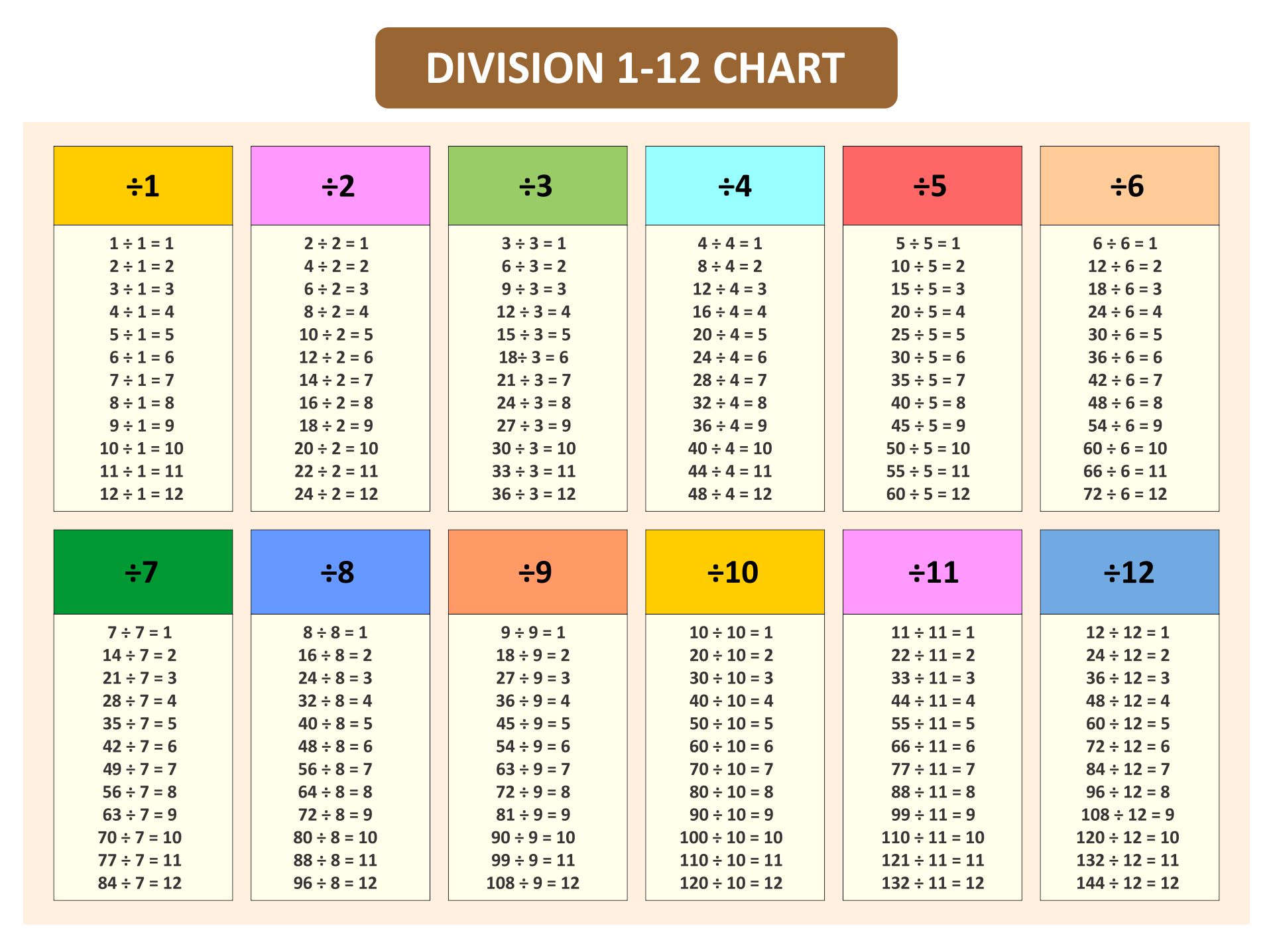

10 Division Table

5 6 Divided By 2

5 6 Divided By 2

28 Divide By 30

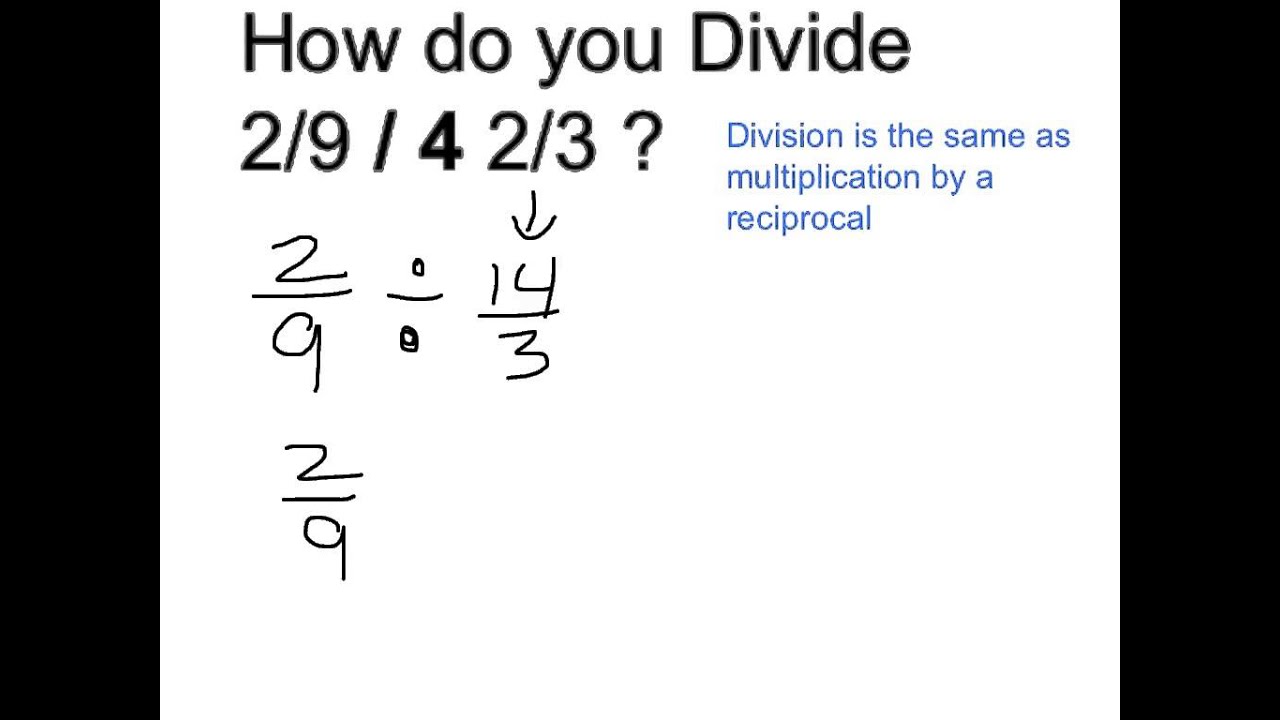

Interpreting Fractions As Division

28 Divide By 30

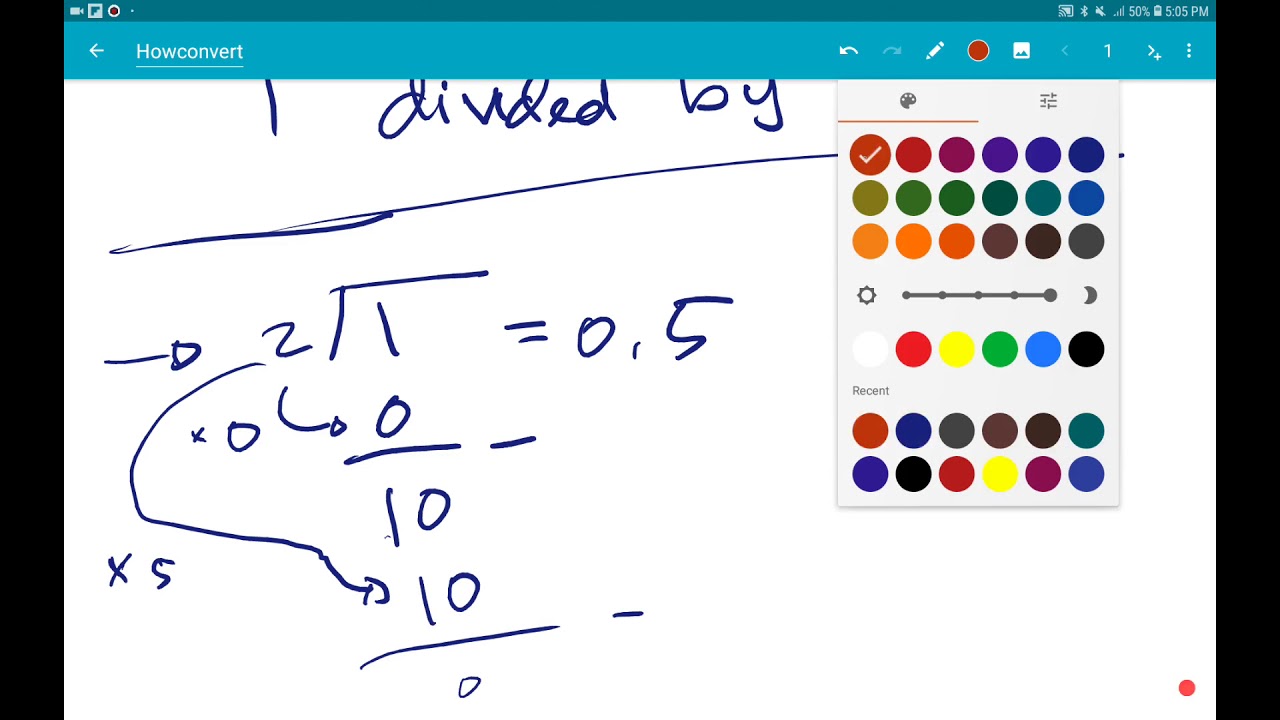

10 Divided By 1 2

10 Divided By 1 2